Introduction

The Australian Maritime Safety Authority (AMSA) is the national Commonwealth Government agency responsible for maritime safety, protection of the marine environment, and maritime and aviation search and rescue.

This Information for industry document is intended to provide regulated industry and AMSA’s compliance partners with an overview of the compliance focus that AMSA will apply over the coming year. It is hoped that this transparency outlining priorities for 2020-2021 will encourage industry to review their operations to ensure compliance with relevant legislation.

- Our regulatory approach

AMSA is dedicated to supporting our regulated community. Fundamental to this is our belief that the responsibility for the safe and appropriate operation of a vessel by its crew rests with its owner and master, and we expect all those involved to act accordingly and comply with the law.

In undertaking our statutory role, AMSA is committed to ensuring compliance and enforcement approaches are risk based, streamlined and coordinated, and proportionate to the risks being managed.

AMSA acknowledges that an appropriate risk-based approach can assist both the regulator and regulated entities by applying resources where they will have the best regulatory effect.

In the maritime safety legislation context, risk based compliance involves:

- undertaking compliance assessment based on relevant information and intelligence analysis

- identifying current and emerging compliance risks

- developing innovative and targeted strategies to effectively address compliance priorities

- using the full range of tools available to AMSA

- implementing those targeted strategies using a planned approach with clear goals which take account of the nature of the industry and the compliance history of industry participants.

AMSA’s regulatory approach is supported by a number of documents, including the AMSA Compliance and Enforcement Policy, Compliance Strategy 2018-2022 and the Statement of Regulatory Approach.

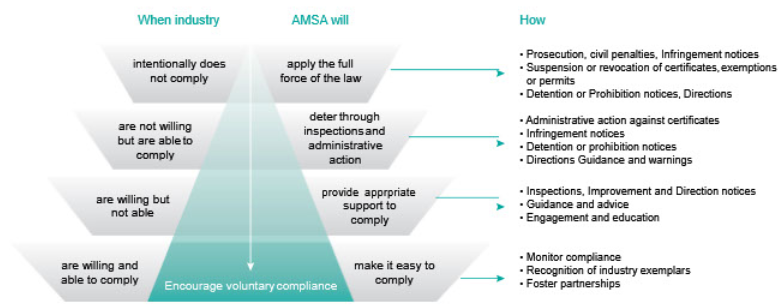

In accordance with the Regulator Performance Framework, and in order to make the best use of its regulatory resources, AMSA adopts a graduated approach to compliance and enforcement to ensure that actions taken are proportionate to the regulatory risk being managed.

We recognise that both compliance mechanisms and enforcement mechanisms are necessary to provide an effective and flexible regulatory system. Accordingly, AMSA will adopt the approach most likely to promote the objectives of the maritime safety legislation, including by encouraging voluntary compliance.

AMSA employs a range of compliance and enforcement options, including:

- engagement and education

- guidance and warnings

- identification of deficiencies

- vessel detentions

- infringement notices

- improvement notices

- prohibition notices

- directions

- undertakings

- suspension or revocation of certification, exemptions or licences

- civil penalties

- prosecution.

AMSA’s compliance approach is depicted graphically in Figure 1:

- Compliance principles

In meeting our compliance and enforcement obligations, and in developing a response to future focus areas, AMSA is committed to the following principles:

Accountability

AMSA’s inspectors and administrative decision makers must be conscious at all times of their role and their accountability for promoting statutory compliance.

Consistency

Like situations will be treated in a like manner. Duty holders need to have full confidence that AMSA’s decision making and compliance actions will be equitable and that comparable situations will have comparable outcomes.

Transparency

Duty holders must be in no doubt as to the criteria used by AMSA in coming to a decision. Decisions and the reasons for making them must be communicated clearly to relevant regulated entities.

Impartiality

Decisions made by AMSA must be both impartial and be seen to be impartial. Any potential conflict of interest that might influence a decision must be disclosed. The decision to take action must not be influenced by:

- the personal views of an inspector concerning the non-compliant person or corporation

- possible political or commercial advantage or disadvantage to the Government or any entity

- public, industry or political criticism, or the possible effect of the decision on the

- personal or professional circumstances of those responsible for the decision.

Proportionality

Decisions made by AMSA will be proportionate to the identified risk to safety or the marine environment, the seriousness of any perceived breach and the level and frequency of non- compliance with legislative requirements.

Fairness

AMSA seeks to strike the right balance between facilitating voluntary compliance and undertaking enforcement actions, while responding to the competing interests of regulated entities, government and the public.

Cooperation

To limit the impact on regulated entitles and to ensure a consistent approach, AMSA works with other agencies that also have a role in the maritime sector. Where possible and appropriate, AMSA has or will enter into a Memorandum of Understanding with these agencies so that all parties are clear as to notification, information sharing, joint investigation and reporting requirements.

These agencies include the Australian Transport Safety Bureau, State and Territory work health and safety and marine safety agencies, State and Territory Police and dangerous goods and electrical safety regulators.

- Complete a training course

General compliance overview

AMSA monitors compliance through a range of activities designed to help us better understand compliance behaviour, encourage and support voluntary compliance, deter non-compliance and inform initiatives to support our compliance partners.

These activities include:

- Audits: Our business audits look at marine incident and compliance trends across the industry by collating and analysing data gathered from accidents, incidents and inspections.

- Inspections: Marine inspectors perform both planned and unscheduled inspections of vessels to determine whether the vessel appears to ensure safety of persons, the vessel itself and protection of the environment. Vessel inspections also serve the purpose of detecting systemic performance issues within the surveyor scheme and other associated entities.

- Campaigns: AMSA works with owners, operators and crew of vessels to promote and encourage marine safety and compliance with requirements. We do this through workshops, information and guidance as well as targeted compliance campaigns to improve safety in high risk industries.

- Compliance checks: For vessels of 7.5 metres or less, compliance checks and monitoring activities are combined with education programs. We have compliance partner arrangements with marine safety, parks, and fisheries organisations, and police agencies across Australia. AMSA staff deliver monitoring activities in connection with staff from our compliance partner organisations.

- Inspector support: The Enforcement and Inspector Support unit provides regular workshops, guidance, advice and support to marine safety inspectors and police agencies to ensure a consistent approach to compliance. In addition to this, the inspector support team regularly meet with representatives of AMSA’s compliance partners to discuss issues and facilitate joint operations.

AMSA’s Operations Division is responsible for carrying out compliance activities, in collaboration with external compliance partners. AMSA utilises a well-developed risk assessment process that identifies where the regulatory effort of compliance activities, such as inspections, should be targeted.

- Currently for port state control this assessment considers risk to the environment, ship complaints, PSC inspection history and data managed on AMSA’s internal systems to calculate the probability of a ship being detained. This results in a risk profile that is used to inform target inspection rates.

- For Australian Flagged vessels (Regulated Australian Vessels), compliance is focussed on classes of vessels which pose the greatest risks. We outsource certain Flag State administration functions to recognised organisations, including survey and certification functions.

- For domestic commercial vessels, compliance is based on data and is focussed on classes of vessels which pose the greatest risks to safety.

AMSA is committed to continuous improvement in safety across both domestic and international vessel operations. With this in mind, AMSA utilises safety data to support the identification of focus areas of concern. Having data that provides a good understanding of the domestic and international commercial vessels’ key risks is vital to future evidenced-based policy decisions to improve safety outcomes.

Accident, incident, inspection and audit data represent the type of safety data available within AMSA to support the identification of trends. The integrity, availability, reliability and maintainability of this data will greatly influence the strength and validity of risk assessments conducted to support safety interventions.

AMSA is working to strengthen safety data collection, recording and analysis processes to improve overall understanding of maritime safety issues providing the basis for more effective safety interventions.

- Compliance focus for 2020-2021

Following are the compliance focus areas that have been determined for 2020-2021. These focus areas were based on recent accident, incident, inspection and audit data.

The focus areas below present recent trends based on data collection and analysis, followed by AMSA’s specific compliance response to address them.

It’s important to note that while AMSA will concentrate its efforts on these areas, if data shows that AMSA needs to broaden or adjust its focus, we will do just that. It’s important that AMSA remains agile in this regard.

Focus Area 1: Port State and Flag State Control

Trends based on audit analysis Operational Requirements: AMSA continues to identify issues with crew being unfamiliar with essential shipboard equipment and procedures. This poses a significant risk to safety and the environment. Navigation Safety: AMSA continues to identify failures in the planning, implementation and monitoring of navigation. This is considered a significant risk. Power propulsion and steering: This represents the most frequently reported category of technical failures and potentially the most serious. Detailed analyses identified main engine/gearing failure as the most common failure type under this category. Container Securing: AMSA continues to identify failures with appropriate container securing/stowing and cargo securing gear. Combined together, this is considered a significant risk. Emergency Generators: Emergency generator failures continue to be a leading source of ship detention in Australia. This is particularly concerning as the emergency power supply is an essential system that ensures safety in the event of any impact on the vessel’s main power supply (i.e., flooding, fire, break down or issues with integrated ship control system; the latter has been the cause of complete ‘black outs’ of passenger vessels). Survival Craft: Accidents with survival craft have caused injury and loss of life to seafarers. The issue relates to the securing and release systems used to provide an ‘on-load’ and off-load’ release option for boats in davits and a free fall release hook for free fall boats. Compliance with Annex VI Of MARPOL and ‘scrubbers’: The introduction of the sulphur cap internationally within Annex VI of MARPOL from 1 January 2020 and carriage ban on high sulphur fuel oil from 1 March 2020 for the carriage of high sulphur fuel were well communicated prior to the implementations dates. This has not prevented some operators assuming that they could expect flexibility in how control would be exercised. In practice AMSA have found that a number of operators did not take appropriate steps early enough to ensure compliance from the relevant cut-off periods. Mooring/anchoring failures: Mooring and anchoring failures are a high percentage of all technical failures. Auxiliary engines/alternators failures: Failures of auxiliary engines or alternators are a high percentage of all technical failures. Communication amongst the crew: The issues in this area are potentially associated with bridge resource management. Specific compliance response:

Continue with target inspection rates based on vessel priority rating. To prevent sulphur emissions, AMSA will conduct a random sampling program of ship fuel, independently testing it to validate the accuracy of bunker delivery notes against the fuel sampled and publish the outcomes. AMSA will conduct an inspection campaign focussed on container securing arrangements and procedures which will include inspections of securing gear. Note – The 2020 Paris/Tokyo MOU member states (including Australia) have agreed that as a response to the COVID-19 crisis that the coordinated inspection campaign focussed on stability (in general) will be postponed from its original September – November 2020 campaign period until 2021 (specific dates yet to be announced). Focus Area 2: Maritime Labour Convention

100% of MLC complaints are followed up When complaints are made to AMSA, AMSA will:

- undertake an initial investigation, which may or may not involve a ship visit

- determine whether the onboard complaints system has been used, and if it has been used, examine

the records of the matter and determine its effectiveness

- promote resolution of complaint at ship board level if appropriate

- notify the flag State if the complaint has not been resolved seeking resolution, advice or corrective action within a prescribed deadline.

Specific compliance response:

AMSA will take a pragmatic approach to applying the Maritime Labour Convention, 2006 (MLC, 2006) requirements for the maximum continuous period that a seafarer can serve on board a vessel without taking leave during the period of disruption that has been caused by COVID-19. Where inspectors identify that a seafarer does not have a valid seafarer employment agreement (SEA), the master will be required to arrange repatriation of the seafarer. No extensions of service without taking leave beyond 14 months will be accepted by AMSA unless the master or owner or both demonstrate satisfactorily to AMSA that all possible efforts have been expended to repatriate the seafarer without success. Focus Area 3: Domestic Commercial Vessels

Trends based on audit analysis Operational Requirements including Safety Management Systems: AMSA continues to identify issues with crew being unfamiliar with essential equipment and procedures on-board and this poses a significant risk to safety and the environment. Crew continue to be unfamiliar with emergency procedures and actions required in the event of an incident. Vessel control and/or navigation: AMSA continues to identify issues with the handling or loss of control of the vessel, and issues with lookout and collision avoidance resulting in contacts and collisions. Failures in this area are associated with the majority of injuries. Main engine/gearing failure: This is the most frequently occurring technical failure, resulting in the vessel becoming disabled and in some circumstances requiring assistance. Persons overboard: AMSA has seen that the majority of person overboard incidents occurred while the vessel was underway. Data indicates that there were more passengers overboard than crew and its more than likely that a vast majority of cases are a deliberate act as opposed to being unintentional. Mooring/anchoring failures: Mooring and anchoring failures are a high percentage of all technical failures Steering gear failure: Steering gear failures are a high percentage of all technical failures Specific compliance response:

Continue with target inspection rates based on vessel priority rating. AMSA will conduct a minimum of 10 at-sea campaigns (equating to at least 60 days at sea) as joint- operations with our compliance partners targeting the crew and fleet of DCVs to address the above identified trends. A minimum of three education safety campaigns focussing on passenger safety (including headcounts), tender operations and EPIRBs (including the new requirement for float-free EPIRBS by 1 Jan 2021) will be conducted in 2020-21. AMSA will continue with our fishing dory safety initiative. A minimum of three focussed inspection campaigns will also be conducted following delivery of the above education safety campaigns. AMSA will publish a report with analysis of incident reports over the last year to identify topics for additional focus in our education and inspection regimes. AMSA will provide targeted guidance and support to our external compliance partners to further improve collaboration and ensure consistency in the regulation of the DCV industry. Note – AMSA is committed to continuing to liaise with industry via AMSAs ‘Regional Safety Committees’ which meet biannually. These eight committees inform and help guide the National stakeholder framework and are a key communication forum for AMSA.

- Inspection focus in 2020-2021

Following are the inspection focus areas that were determined for the 2020-2021 period.

Port State Control

Each vessel category has a specific target inspection rate resulting from the risk profiling system described above.

Priority Group Probability of detention (risk factor) Target inspection rate Priority 1 More than 5% 80% Priority 2 4% to 5% 60% Priority 3 2% to 3% 40% Priority 4 1% or less 20% Data collected during this period, along with targeted inspection rates indicates AMSA surveyors are being used in the most effective manner and are achieving target inspection rates in all priority groups.

Flag State Control

Prior to the recent changes in AMSAs International Safety Management (ISM) Code auditing function, AMSA aimed to carry out a Flag State Control (FSC) inspection of each Regulated Australian Vessel (RAV) regulated under the Navigation Act 2012 once per year.

As at July 2020 there are an estimated 60 RAVs which are eligible for a FSC inspection. This number fluctuates by up to 20% annually for a range of reasons including new vessels being registered, old vessels decommissioning, sea trialling of new builds, removal from register for sale, and transfer of flag.

AMSA aims to conduct FSC inspections on RAV’s twice in a 12 month period. Considering the fluctuation in numbers, location of these vessels, and nature of their voyages, AMSA’s FSC target for 2020-2021 is to conduct 120 inspections of RAV’s under the FSC regime, during this reporting period.Importantly all FSC inspections include an Occupational Health and Safety (Maritime Industry) Act 1993 (OHS(MI)) inspection component.

AMSA applies the same priority (P1-4) of inspection for our Flag State Control regime as we do for Port State Control.

AMSA can also conduct an (OHS(MI)) inspection independently of a FSC inspection where the OSH(MI) act applies. AMSA inspectors remain available to discuss health and safety matters with any crew member, including the Health and Safety Representatives (HSR). HSRs may also request that AMSA conduct an OHS(MI) inspection on board a vessel, and to accompany the AMSA inspector on such an inspection.

AMSA’s Inspectors will seek opportunities to discuss safety matters with the HSRs on a regular basis.

Domestic Commercial Vessels

Based on a risk review it was determined that the highest priorities and focus for domestic commercial vessel safety compliance were fishing vessels and large passenger carrying vessels. In regards to fishing vessel safety, the focus was particularly on stability, procedures in reaction to a hook up, the safety of dories / tenders / auxiliary vessels and general seaworthiness.

AMSA will conduct a total of 2200 inspections. AMSA will target our inspections based on the priority groups and inspect a larger proportion of the higher priority operations in the fleet than those of lower priority.

Priority 1 vessels

- Passenger vessels of any category carrying more than 36 passengers

- Fishing vessels of category 3B Extended, 3B and 3C

- Class 2 vessels engaged in high risk operations (these include carriage of bulk petroleum or gas products, vessels with cranes exceeding 3 tonnes and dredges).

Priority 2 vessels

- Passenger vessels of any category carrying up to 36 passengers

- Existing non-survey Fishing vessels of category 3C restricted 3D and 3E

- Class 2 vessels engaged in medium risk operations (these include support vessels in the offshore oil industry, any vessel carrying dangerous goods, landing barges, tugs/ vessels used primary for towage).

Priority 3 vessels

- Cargo vessels of Class 2B Extended, 2B, 2C, 2D and 2E (including barges) not involved in high or medium risk operations.

Priority 4 vessels

- All vessels not covered by priorities 1 to 3 – these inspections may be part of a compliance visit or fleet monitoring visits.

- AMSAs response to COVID-19

AMSA is aware of the impact that COVID-19 is having on the maritime industry across Australia. AMSA is committed to reducing the regulatory burden on Australian and international maritime industries. We have a number of exemptions that may assist during this time and are working with industry on a case by case basis.

While AMSA may have reduced its presence in the field in order to protect the safety of staff and industry, and inspection targets may be impacted by COVID-19, AMSA will still conduct inspections and surveillance activities as necessary, including following-up on incidents, and will continue to fully investigate the most serious of incidents.

AMSA will continue to apply its compliance and enforcement policy in all cases, and where the risk is such that action must be taken, AMSA and its compliance partners will do so. However, AMSA will continue to work with you to bring your operation back into compliance and back on the water as soon as possible.

This is a shared problem, which comes with a shared obligations and responsibilities to ensure that industry can operate safety, and with as little regulatory burden as possible.