Cost recovery involves government entities charging individuals or non-government organisations some or all of the efficient costs of a regulatory charging activity. This may include goods, services, or regulation, or a combination of them. The Australian Government Charging Framework, which incorporates the Cost Recovery Guidelines (the CRGs)1, sets out the framework under which government entities design, implement and review regulatory charging activities.

1. The Australian Government Charging Framework and the Cost Recovery Guidelines are available on the Department of Finance website.

- 1 Introduction

1.1 Purpose of Cost Recovery Implementation Statement

This Cost Recovery Implementation Statement (CRIS) provides information on how the Australian Maritime Safety Authority (AMSA) implements cost recovery for the provision of infrastructure and regulation to support safe ship navigation in Australian waters, environmental marine protection, seafarer and ship safety, ship registration, and related marine services under both the Navigation Act 2012 and National System for domestic commercial vessels. It contains financial results for 2018–19 and budget forecasts for 2019–20 and the three following years.

This document provides key information on the application of cost recovery activities, including financial and non-financial performance. It assists stakeholders to understand AMSA’s costs, which strengthens accountability, provides transparency, and demonstrates compliance with CRGs and the Regulatory Charging General Policy Order.

1.2 Description of the regulatory charging activity

1.2.1 Policy background

Our policy outcome is to ‘minimise the risk of shipping incidents and pollution in Australian waters through ship safety and environment marine protection regulation, and to maximise people saved from maritime and aviation incidents through search and rescue coordination2.

2. Department of Infrastructure, Transport, Regional Development and Cities, Portfolio Budget Statement 2019-20, Budget Related Paper No. 1.12, page 80.

1.2.2 Description of the activities

Regulatory charging activity outputs are summarised in Table 1, with the funding mechanism contained in brackets.

Table 1: Descriptions of AMSA’s regulatory charging activities

Activity output Description Navigational infrastructure (Marine Navigation Levy) Maintain a national network of integrated aids to navigation (AtoN) and traffic management measures in Australian waters3 to ensure safe and efficient coastal navigation of the commercial shipping industry. This includes the provision of technical maintenance and engineering project management services.

Other activities include shaping and ensuring appropriate international maritime standard setting at:

- International Maritime Organization (IMO) (eg Australia’s international obligations under International Convention for the Safety of Life at Sea (SOLAS)), and

- International Association of marine aids to navigation and Lighthouse Authorities (IALA).

Environmental marine protection (Protection of the Sea Levy) Resources the National Plan for Maritime Environmental Emergencies (National Plan), which is a cooperative arrangement between the Commonwealth, States and Northern Territory, and commercial shipping industry.

The National Plan details processes about pollution response incidents including:

- funding arrangements for clean-up costs relating to ship sourced pollution, and

- pollution that cannot be attributed to any specific vessel or cannot be wholly recovered from insurance providers.

Another primary function is funding the National Maritime Emergency Response Arrangements, as well as the maintenance of preparedness to combat pollution by ensuring there is adequate capability to respond to incidents through:

- training of personnel in response techniques

- acquisition, maintenance, and stockpiling of relevant equipment and supplies at key sites around Australia, and

- provision of emergency towage capability.

Seafarer and ship safety under Navigation Act 2012 and other Acts (Regulatory Function Levy) Conduct a range of maritime safety and regulatory activities on international and national commercial shipping operations. This consists of compliance inspections and audits undertaken on a risk based sample approach.

A fundamental component of the activity is port State control inspections, which are inspections to ensure vessels and ship owners or operators comply with regulations relating to vessels, crew, and marine environment.

Other inspections and audits include:

- flag State control inspections

- marine surveys

- cargo and handling related inspections

- marine qualification duties and accreditations, and

- audits of registered training organisations.

Promoting a culture of safety in the maritime industry through development of policies, guidelines, and technical requirements (Marine Orders) relating to legislative functions, is an integral component of the activity.

Seafarer and ship safety also includes the development of Australia’s maritime regulations and participation in international and regional maritime forums. It involves developing international standards on seafarer and ship safety and environmental protection, including harmonisation to international standards (and national standards), mainly promulgated by the International Maritime Organization (IMO), International Labour Organization, and members of the Tokyo and Indian Ocean Memoranda of Understandings.

Marine services Navigation Act 2012 and ship registration under Shipping Registration Act 1981 (Fee Determination) Provides a range of fee-based activities for the following:

- services to seafarers and coastal pilots (mainly qualifications), including approvals, issuing permits, authorisations, certifications, conducting examinations, and licensing for domestic and internationally recognised marine qualifications

- inspections and surveys requested by ship owners (or agents)

- shipping registration of Australian flagged vessels, including ensuring ships are maintained and crewed to a suitable standard, and

- other services, including determinations and exemptions.

Marine services under National System for domestic commercial vessels (Regulations) From 1 July 2018, AMSA transitioned to become the national regulator for domestic commercial vessels and seafarers, previously regulated by the states and Northern Territory agencies.

As part of the transition, levy-based activities continue to be government funded, with fee-based activities cost recovered from industry.

The fee-based activities provided are:

- certificates of operation, including assessment of application and issuing approvals for vessels to operate within certain defined areas and purposes

- certificates of survey, including assessment of applications, and issuing approvals and certificates, to operate as a commercial vessel ensuring vessels comply with Australian law and standards

- seafarer certificates of competency – near coastal, including approvals, assessing revalidations, issuing certifications, and conducting examinations for recognised marine qualifications

- marine surveyor accreditation scheme to monitor and maintain competency of the network of accredited surveyors in the non-government sector, and

- assessment of applications requesting exemptions from standards and regulation of the National System or equivalent means of competency.

3. AMSA does not provide navigational aids within port boundaries; these are the responsibility of the port operator.

This CRIS does not cover:

- Levy-based regulatory activities of the National System for domestic commercial vessels.

On 2 July 2018, the Australian Government announced an additional $10 million funding to delay charging levies to industry for the first three years of service delivery. These activities will continue to be funded by a combination of Commonwealth appropriations and by States and Northern Territory jurisdiction contributions—total funding by all governments is now $112.4 million over ten years.

The additional time will enable AMSA to engage with industry on a range of matters as part of a review of National System operating costs and funding, scheduled to commence in 2020-21. This will include extensive stakeholder consultation on service delivery and will provide an opportunity to address industry concerns, including:

- The additional time will enable AMSA to engage with industry on a range of matters as part of a review of National System operating costs and funding, scheduled to commence in 2020-21. This will include extensive stakeholder consultation on service delivery and will provide an opportunity to address industry concerns, including:

- most effective and efficient way to deliver services

- opportunities to reduce costs without comprising safety, and

- ways to reduce administrative burden.

- Search and rescue coordination services for maritime and aviation incidents, which are funded by government budget appropriations.4

- Funding arrangements of shipping and offshore petroleum industries and the International Oil Pollution Compensation (IOPC) fund5.

- Externally funded programs sponsored by various government departments for the provision of specific maritime related services.

4. The Government reaffirmed its initial policy, upon the establishment of AMSA in 1991, through the Strategic Review of Search and Rescue Service and pricing study in 2001 that search and rescue activities will remain funded from taxpayer funded budget appropriations.

5. The Protection of the Sea (Oil Pollution Compensation Funds) Bill 1992 essentially established the procedure by which entities are required to provide details of oil receipts to the IOPC fund through AMSA - this is not a cost recovery arrangement.

1.2.3 Appropriateness of cost recovery activities

It is government policy that when an individual or organisation creates a demand for a government activity, there should generally be a charge for the provision of these activities.

Participants in the commercial shipping industry pay the costs attributable to the provision of navigational infrastructure within Australian waters, environmental marine protection, seafarer and ship safety, marine services under Navigation Act 2012, ship registration, and National System for domestic commercial vessels.

Regulatory functions in many instances may be applicable across AMSA’s various activity outputs, such as emergency towage capability and work health and safety. Over time, a clearer demarcation of the costs to be borne by industry will be better understood.

Government policy is not to charge a levy for National System for domestic commercial vessel activities until afore mentioned regulatory review is undertaken in 2020–21, assessing costs, funding options, and reducing administrative burden to industry.

Further, Government continues to funds search and rescue services attributable to community service obligations to the broader community through budget appropriations.

1.2.4 Stakeholders

The principle stakeholders for regulatory charging activities in this CRIS are:

The principle stakeholders for regulatory charging activities in this CRIS are:

- ship owners and operators, and their associated agents – international vessels (~5,800) and domestic commercial vessels (~27,000)

- seafarers and coastal pilots—international (~60,000) and domestic (~66,000)

- accredited marine surveyors (~250)

- registered training organisations

- Commonwealth, State and Northern Territory agencies, and

- the Australian community.

- 2 Policy and statutory authority to recover

2.1 Government policy approval to cost recover regulatory activities

The Explanatory Memorandum of the Australian Maritime Safety Authority Act 1990 states the Government’s intent that AMSA ‘will run its commercial services on a self-funded basis; services which cannot be provided on a self-funded basis (search and rescue coordination services) will be paid by the Commonwealth’.

AMSA recovers costs from participants in the commercial shipping industry in adherence with Public Governance, Performance and Accountability (Charging for Regulatory Activities) Order 2017, which refers to the Australian Government Charging Framework and CRGs.

AMSA’s regulatory charging activities are authorised by the application of Australian Commonwealth legislative instruments, in particular Part 5, Division 2 of the Australian Maritime Safety Act 1990, which provides for the charging of levies and fees with references to the following Acts:

- 3 Cost recovery model

3.1 Outputs and business processes of the regulatory charging activities

3.1.1 Activity outputs

As described in policy background (Section 1.2.1), AMSA’s role is to deliver on seafarer and ship safety, and environmental marine protection through regulation, and provide search and rescue capability. The broad outputs and primary activities for these roles are itemised in Table 2, which also notes whether the output is a regulatory charging activity.

Table 2: AMSA’s broad activity output listing

Activity output Primary activities Regulatory charging? Search and rescue activities and functions - Operating AMSA Response Centre, coordinating maritime and aviation search and rescue.

- Providing two ground stations and Mission Control Centre for the Cospas Sarsat distress beacon detection system.

- Maintaining maritime distress and safety communications services.

- Providing dedicated airborne search and rescue services.

No, funded by government budget appropriations Navigational infrastructure - Providing and maintaining a national network of marine aids to navigation (AtoN) and related navigational systems and measures.

- Intergovernmental and international engagement to shape and ensure appropriate maritime standards are in place (e.g. for Australia’s obligations under SOLAS convention and for the provision of AtoN through IALA).

Yes Environmental marine protection - Managing the National Plan, including crisis preparedness to combat environmental emergencies (pollution incidents).

- Regulating, monitoring, and coordinating maritime casualty management and emergency towage capability.

- Conducting pollution prevention public awareness and education campaigns.

Yes Seafarer and ship safety under Navigation Act 2012 and other acts - Monitoring compliance with operational standards for ships in Australian waters, under the Act, to ensure their seaworthiness, safety and pollution prevention.

- Participating in the development and implementation of national and international marine safety and environment protection standards.

- Providing public access to ship safety and environment protection standards and policies.

- Administering training standards for seafarers and coastal pilots.

- Conducting safety public awareness and education campaigns.

- Exercising occupational health and safety inspectorate functions.

Yes Marine services under Navigation Act 2012 and ship registration under Shipping Registration Act 1981 - Administering competency of qualifications for seafarers and coastal pilots.

- Conducting inspections, surveys, and audits requested by ship owners or their agents.

- Administering Australia’s ship registration system.

Yes Marine services under National System for Domestic Commercial Vessels - Assessing applications and issuing approvals and certificates of operation, survey, and competency of near coastal seafarer qualifications.

- Administering, monitoring, and maintaining network of accredited marine surveyors.

- Assessing applications that request exemptions from the application of National Law, and equivalent means of competency.

Yes Seafarer and ship safety under National System for Domestic Commercial Vessels - Monitoring compliance with operational standards for the domestic commercial vessel fleet to ensure their seaworthiness.

- Participating in the development and implementation of domestic marine safety and environment protection standards.

- Providing public access to ship safety and environment protection standards, policies and regulations.

- Administering the training standards for domestic seafarers and pilots.

- Conducting safety public awareness and education campaigns.

No, funded by combination of government budget appropriations and jurisdiction contributions Externally funded programs - Externally funded programs sponsored by various government departments for provision of specific maritime related services, predominantly in relation to search and rescue capabilities.

No, funded by various government departments Operational targets of these activity outputs are detailed in the Annual Performance Statements of AMSA’s Corporate Plan, which describes the reportable measurements in achieving AMSA’s policy outcomes. A summary is provided in non-financial performance (Section 7B).

3.1.2 Business processes

Levy-based activities

Levy-based regulatory charging activities relate to the provision of a total function (statutory regulations) as opposed to transactional business processes; the costs for delivering these activities are not on a transactional basis, rather driven by the support to achieve overall activity output outcomes and non-financial performance targets.

Fee-based activities

Driven by distinct business processes, fee-based regulatory charging activities support specific regulatory functions to which the fees relate. Generic business processes for AMSA’s fee-based activities include:

- receipt and review of an application, including initial engagement and ongoing consultation with the applicant

- undertaking technical assessment, with a decision made by a delegate, and

- processing and issuing a certificate, license or approval.

In practice, administrative business procedures for the receipt, review and issue are broadly similar across fee-based charging activities. However, time and effort (and associated costs) for technical assessments and decisions vary between the types of outputs and on the complexity or nature of the application.

3.2 Costs of the regulatory charging activities

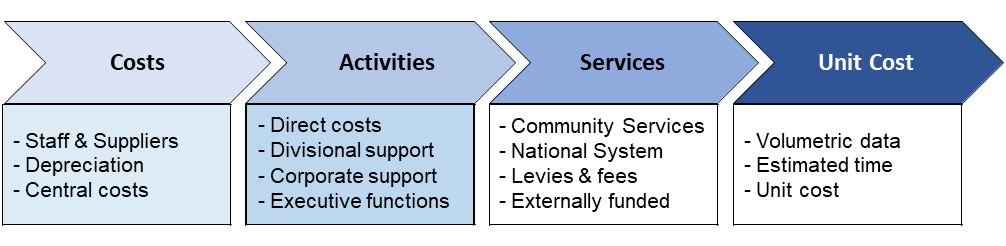

AMSA applies an activity-based costing allocation methodology to determine costs for activity outputs and regulatory charging activities. This holistic approach incorporates the entirety of its cost base, in accordance with the Financial Management Information System (FMIS), and allocates these costs to activity outputs based on estimated time and effort, and drivers. An illustration of the methodology applied in AMSA’s costing model is depicted in Appendix 1.

Costs are classified as either direct or indirect (overhead). These are reviewed on an annual basis to determine operational requirements against expected demand and estimated revenue in order to ascertain efficiencies (or savings) that may be achieved.

The approach to set budgets and to estimate actual expenditure aligned with source funding appears efficient and effective. Nevertheless, AMSA is commencing a process to benchmark costing methods with other domestic and international government entities that provide similar regulatory activities to the non-government sector. This will take time to develop, but this is identified as an area for improvement.

3.2.1 Changes to costing model techniques

In 2018–19, and in response to the findings identified in Australian National Audit Office performance audit report, AMSA implemented improvements to its costing model techniques, including alignment of costs to individual outputs, developing more accurate cost drivers for corporate functional costs, refined direct costs, and allocated corporate overheads across all activities based on normalised revenue estimates.

Normalised revenue was used as the driver for corporate overhead allocations on the assumption this basis more accurately reflects the level of support provided by corporate support, governance and executive functions. This method is more accurate than allocation based on direct staffing levels, which inadvertently allocates a larger share of overheads to people-intensive outward facing activities, despite being more process driven and consuming less executive and governance overhead. This involved an analysis of trends in revenue estimates based on expected drivers, such as ship arrivals trends.

Two costing models were developed. To facilitate the collection of data for inputs into the first costing model, an analytical activity-based costing allocation approach was developed, with business line managers providing inputs for the allocation of time and effort for staff and supplier costs into sub-activities.

The second model only involved fee-based activities. A program was undertaken to capture timesheet information from specific business units over an eight-week period. Information gathered also included estimated time to complete each individual fee-based activity from business line managers. These data, combined with actual volumetric data, developed a fee-based bottom-up cost model, with an overhead rate applied.

Differences between models for fee-based activities were identified, with costs in the first model being higher. The excess was tested and determined to be levy-funded regulatory framework effort, with costs assigned as such.

As part of its continuous improvement strategy, AMSA is in the process of investigating and understanding costs that underpin fee-based activities. This will involve more granular costing at the business processes level.

For the next costing model development (2020-21 budget), AMSA is developing a zero-based and activity-based budgeting exercise, which will allow the model to be refined and costed using a bottom-up approach to AMSA’s regulatory activities. The development of this model will list current and new activities for service delivery, rank these activities, identifying resources required, aligning costs to activities, set a procedure for the allocation of corporate functions, and develop key performance indicators for discussion with external stakeholders.

3.2.2 Nature of costs

The nature and make-up of costs vary considerably across AMSA’s regulatory charging activities. For example, for the provision of aids to navigation there is an extensive capital cost component (depreciation and amortisation), with consistently high operational maintenance costs, reflecting the hostile weather and corrosive environments in which these assets operate.

In contrast, seafarer and ship safety regulations (for both levy and fee-based activity outputs) is labour intensive and as such has a high staff cost component. Activities with a large staffing level require a higher proportion of property operating expenditure and ICT overheads compared to activities that have minimal labour inputs—refer to overhead costs (Section 3.2.4).

3.2.3 Direct costs

Direct costs are those costs directly and clearly attributed to activities based on estimations of resource requirements for the delivery and provision of statutory and regulatory obligations. These costs may include employee costs, suppliers, and depreciation and amortisation.

Direct staff costs are allocated to activities based on an analysis, undertaken by business unit managers, of staff utilisation to achieve operational outcomes. This analysis provides and validates estimated time and effort requirements of staff assigned to each direct activity.

Direct supplier costs are assigned to activities based on an analysis of the nature of expenditure, validated by business unit managers. Supplier costs include travel and transport costs, materials and services, communication, and administrative expenses.

3.2.4 Overheads

Overheads include costs that can be either be, directly attributed to staffing levels for activities, such as property operating expenditure and information technology costs, or costs that cannot be attributed to an activity, such as corporate services and executive function support.

AMSA’s overheads are classified into the following categories (narration of the costs and their treatment in the costing model is provided):

- Property operating expenditure (POE)

The nature of AMSA’s policy outcome requires the provision of maritime infrastructure in the form of aids to navigation, stockpile facilities for marine environmental protection and search and rescue functions, and inventories for environmental emergencies, as well as an obligation to maintain a regional presence across Australia. This corresponds to a sizeable property footprint and associated operational expenditure.

These overhead costs are allocated to either business units based on occupancy rates for each location (for offices and remote area residential property), or directly to activities (for storage and aids to navigation).

- Information Technology (IT) and communications

This covers software licensing and maintenance not directly attributed to activity outputs, as well as outsourced IT network and desktop support services, and general telecommunication expenditure not directly attributable to an activity.

Costs are assigned to business units based staffing level proportions.

- Corporate support and executive functions

Determined with reference to an analysis and estimations undertaken by business unit managers, these costs predominately consist of corporate services (IT staff costs, communications, human resources, finance, and governance), and executive functions support, including Board, and legal services not directly attributable to an activity output.

Allocated to activity outputs based on revenue earned and normalised to consider the level of time and effort provided, and then to activity groups by direct staffing levels, after divisional support costs are assigned.

Table 3 contains the corporate support and executive function overhead rates applied for 2019–20.

Table 3: Corporate overhead percentage allocations to outputs for 2019–20

Activity output Rate Regulatory charging activity outputs 67.9% Navigational infrastructure 19.9% Environmental marine protection 19.9% Seafarer and ship safety under Navigation Act 2012 and other Acts 24.8% Marine services under Navigation Act 2012 and ship registration 1.6% Marine services under national Ssstem 1.7% Non-regulatory charging activity outputs 32.1% Total 100.0% Further information is provided in key cost drivers and assumptions underlying the model (Section 3.2.7).

3.2.5 Capital costs

Depreciation and amortisation expenditure is a good representation of AMSA’s capital costs, and used to determine capital expenditure requirements for the replacement and enhancement of assets. These costs are either attributable directly to the relevant activity, where there is a direct link, or on the overhead basis noted in overhead costs (Section 3.2.4) dependent on the overhead classification.

3.2.6 Attribution of costs to non-charging activities

Staff providing regulatory charging activities may also undertake other activities funded by either government budget appropriations (search and rescue coordination services and levy-based National System activities) or Australian Government agencies for targeted externally funded maritime related programs (externally funded programs).

Costs for non-regulatory charging activities are largely identified during a detailed activity analysis by business unit managers, with overheads allocated to these outputs using the same process as noted at 3.2.4 above.

3.2.7 Key cost drivers and assumptions underlying the model

AMSA’s direct costs for regulatory charging activities is ~79.8%, with overheads being ~20.2%, this is summarised in Table 4.

Table 4: Cost category break-down of regulatory charging activities for 2019–20

Cost category ($’000) % Direct (staff, suppliers, depreciation and divisional support) 96,871 79.8% Overheads 24,476 20.2% Total 121,347 100.0% Direct costs are broken down further into cost types, staff (~33.0%), suppliers (~56.7%), and depreciation (~10.3%).

For staff costs, the driver is the time and effort spent on an activity, whereas for direct supplier costs the driver is the contracted service agreements for the provision of services, such as aids to navigation maintenance. However, this largely depends on the nature and cost of the activity, as mentioned in nature of costs (Section 3.2.2).

Assumptions underlying the model include:

- normalised revenue proportion is a reflective indicator of actual time and effort by corporate support and executive functions for overhead allocations, and

- capital costs is represented by depreciation and amortisation since these reasonably reflect the costs associated with asset replacement and enhancement.6

6 This assumption is under review as AMSA is updating its capital management plan, which will enable a comprehensive determination of asset and capital requirements, including maintenance, and any potential shortfalls that may exist in capital funding.

3.2.8 Sensitivity of cost estimates to changes in assumptions

Assumptions underlying the cost recovery model are developed to limit and constrain any significant sensitivity to the cost estimates from changes in cost drivers or demands in regulatory charging activities.

Costs predominately consist of suppliers and staff. Supplier costs are largely longer-term contracts where expenditure relates to service requirements or deliverables. These are generally not dynamic or responsive to short-term changes in demand of regulatory charging activities. Staff costs have a similar constraint for short-term movements of demand, and are based on long-term expected time and effort requirements to meet policy outcomes as identified by business unit managers.

In determining the staff and supplier cost levels, AMSA forecasts the expected level of demand for regulatory charging activities as part of its annual budgeting processes. This process is based on historical data and trends, consultation advice, understanding known economic factors, and thorough communication with principle stakeholders.

3.2.8 Cost estimates for 2019–20

Estimated costs for providing AMSA’s regulatory charging activities, broken down into direct average staffing levels (ASL), direct costs and overheads, are set out in Table 5.

Table 5: Breakdown of costs estimates for 2019–20

Activity output and groups Direct

ASL*

Direct

($’000)

Overhead

($’000)

Total

($’000)

Navigational infrastructure 21.3 31,732 5,136 36,868 Provision and maintenance of aids to navigation, including contract management 9.3 21,967 2,442 24,409 Emergency towage capability - 4,831 - 4,831 Business, regulations and legislative support 6.0 1,990 1,283 3,273 Intergovernmental and international engagement to ensure appropriate standard setting 4.4 1,409 1,026 2,434 Other activities specific to navigational infrastructure** 1.5 1,536 385 1,921 Environmental marine protection 30.7 29,184 5,717 34,901 Crisis preparedness to combat environmental emergencies, including training and methods for pollution response 8.8 10,441 1,609 12,050 Emergency towage capability 2.0 11,409 307 11,716 Intergovernmental and international engagement to ensure appropriate standard setting 5.4 2,006 965 2,972 Communications, media and parliamentary liaison for spill and pollution incidents 4.3 1,418 669 2,087 Business, regulations and legislative support 4.3 959 660 1,618 Specific legal advice, administration and representation in court and tribunals for environmental marine protection 1.2 1,168 257 1,425 Providing public access to environmental protection standards and policies 3.2 770 576 1,346 Managing resources of the National Plan 1.6 514 674 1,188 Other activities specific to environmental marine protection** - 499 - 499 Seafarer and ship safety under Navigation Act 2012 and other Acts 78.1 25,842 10,359 36,202 Monitoring compliance of operational standards for seafarers and ships to ensure seaworthiness, safety and pollution prevention 32.3 11,194 4,564 15,758 Providing access to seafarer and ship safety standards and policies 16.5 4,311 2,048 6,359 Intergovernmental and international engagement to ensure appropriate standard setting 8.9 3,366 1,087 4,453 Business, regulations and legislative support 9.9 3,019 1,352 4,370 Specific legal advice, administration and representation in court and tribunals for seafarer and ship safety 4.8 1,410 575 1,985 Contact Centre—seafarer and ship safety 2.6 853 368 1,221 Other activities specific to seafarer and ship safety** 3.1 1,690 366 2,056 Marine services under Navigation Act 2012 and ship registration 16.3 4,865 1,610 6,474 Services to seafarers and coastal pilots, including examinations, assessments, and certification 5.5 2,062 608 2,670 Inspections and surveys 4.6 1,370 400 1,770 Ship registration 3.4 744 377 1,121 Others marine service activities** 2.7 689 225 914 Marine services for national system 19.0 5,248 1,654 6,902 Certificate of survey 4.5 1,070 355 1,426 Certificate of operation 5.9 1,457 503 1,960 Certificate of competency – near coastal 4.8 1,846 476 2,322 National law exemptions 2.8 693 244 936 Marine surveyor accreditation 0.8 182 76 258 Total for regulatory charging 165.4 96,871 24,476 121,347 * Does not include non-regulatory charging activities; only direct regulatory charging activities.

** Consists of various activities considered minor (e.g. individual costs <$1.0 million), except where noted.

3.3 Design of regulatory charges

Regulation of international and domestic commercial shipping is complex, with a wide range in the variety of vessel types, manning levels, competency requirements, and handling of various cargoes.

From 2013–14 to 2018–19, the number of levy liable visits under the Navigation Act 2012 to Australian ports by applicable foreign-flagged and domestic coastal trading vessels has remained steady, with a slight increase from ~10,000 per annum in 2013-14 to ~10,500 in 2018-19. However, total net registered tonnage volumes (the basis for collection levies) have steadily increased; signifying larger vessels are visiting Australian ports.

The majority of vessel type visits for 2018–19 continues to be bulk cargo carriers (iron ore, coal and general) (~79.6%), with liquid product and gas tankers (~8.3%), and container vessels (~5.6%) largely making up the balance. AMSA notes that over this period that the proportion of liquid product and gas tankers has been steadily rising, corresponding with Australia’s increase in gas exports.

The average number of port visits during each levy payment period (i.e. three months) varies depending on the vessel type and cargoes, with bulk cargo vessels averaging around one to two visits per levy payment period and container ships around five to six.

These factors mean that any projections of expected growth (or reductions) in demand for regulatory charging activities must consider the complex relationships within the commercial shipping industry.

3.3.1 Charging structure

The design of AMSA’s regulatory charging activity outputs considers whether a service is provided to an individual entity (where costs can be reasonably attributed to that entity) or whether the activity involves a group of entities (provided to the commercial shipping industry and the broader community).

AMSA applies a ‘user pay’ principle for regulatory charging activities. Navigational infrastructure (Marine Navigation Levy) and seafarers and ship safety under the Navigation Act 2012 and other Acts (Regulatory Function Levy) is charged against vessels that use the national network of integrated aids to navigation and traffic management measures in Australian waters and are subject to safety regulatory activities. Environmental marine protection (Protection of the Sea Levy) is charged against vessels that have the potential to be polluters of the marine environment. Fee-based activities are charged for performance, on the application or request of, a particular individual or organisation, which receive or use the benefits.

AMSA’s broad charging structure is shown in Table 6.

Table 6: Charging structure

Activity output Method Structure Navigational infrastructure Marine Navigation Levy Net registered tonnage – sliding scale Environmental marine protection Protection of the Sea Levy Net registered tonnage – linear Seafarer and ship safety under Navigation Act 2012 and other Acts Regulatory Function Levy Net registered tonnage – sliding scale Marine services under Navigation Act 2012 and ship registration Fee Determination

(fee-based activities)

Direct (fixed) fee or hourly rate Marine services under National System National Law Regulation

(fee-based activities)

Direct (fixed) fee or hourly rate Levy-based activities

The commercial shipping industry pays levies on non-exempted vessels7 that are twenty-four (24) metres or more in tonnage length, with the rate based on a vessel’s net registered tonnage (NRT), with environmental marine protection output charged for vessels that also carry ten (10) or more tonnes of oil on board8 with a minimum amount payable of $10.

A summarised Levy Ready Reckoner is shown in Table 7.

Table 7: Levy Ready Reckoner

Net Registered Tonnage (NRT)

From

0

5,001

20,000

50,000

To

5,000

19,999

49,999

∞

Levies Cents per NRT

Cents per NRT

Cents per NRT

Cents per NRT

Marine Navigation Levy (MNL) 23.50

12.00

7.00

2.50

Regulatory Function Levy (RFL) 17.00

17.10

17.00

15.50

Protection of the Sea Levy 11.25

11.25

11.25

11.25

Levy calculation 51.75c for each tonne $$2,587.50 plus 40.53c for each tonne over 5,000 $8,640.00 plus 35.25c for each tonne over 20,000 $19,215.00 plus 29.25c each tonne over 50,000 * Schedule of levy rates are contained in each respective levy legislative instruments.

International vessels are liable for levies on either the day of arrival to an Australian port, or where the vessel remains in Australia and not paid the corresponding levies in the previous three months, the day after the end of that period. For Australian coastal trading vessels, unless the vessel is out-of-service, levies are payable at the start of each quarter.

AMSA’s methodology for charging levies is derived from historical predecessors, as well as international standards where banding by net registered tonnage is considered common practice for the commercial shipping industry. Levy rates within these bands are adjusted periodically, with the last change occurring in 2014–15.

7 There is a list of exemptions contained in the Marine Navigation Levy Collection Regulations 2018, Marine Navigation (Regulatory functions) Levy Collection Act 1991, and Protection of the Sea (Shipping Levy) Regulation 2014.

8 There will be situations where vessels exempted from both the Marine Navigation Levy and Regulatory Function Levy may be liable for the Protection of the Sea Levy. Generally, these vessels include fishing, religious charitable, non-for-profit organisation, or research vessels.

Fee-based activities

Comprises assessments of applications, inspections and surveys undertaken, registrations, conduct of examinations, and accreditations of non-government service providers. These activities are either, average time and effort requirements and associated hourly rates of labour and overheads costs, or fixed rates.

Fixed fees are applied to those regulatory activities where the range of typical delivery times do not vary significantly from the standard average time. Where there are wide variations, indicated by significant divergences from the standard deviation, the relevant charge is based on an hourly rate, plus any reasonable unavoidable travel costs. These travel costs may be flights and accommodation, where services are provided at locations remote from AMSA’s regional office9, or motor vehicle travel rates where vehicles are used for the mode of transport to and from offices.10

For 2019–20, the hourly rate for services provided under the Navigation Act 2012 will remain at $272, with national system fee-based activities rate increasing to $241 (from $238) in accordance with indexation provisions within the regulation. This is an increase of 1.3%.

The current schedule of fees-based regulatory charging activities is included in Appendix 2. Charging rates are also published on AMSA’s website.

3.3.2 Revenue estimates

Revenue estimates for 2019–20 (Budget) and the three forward estimates is summarised in Table 8, which corresponds with the 2019–20 Portfolio Budget Statement.

Table 8: Revenue estimates

Activity outputs 2019-20

($’000)

2020-21

($’000)

2021-22

($’000)

2022-23

($’000)

Levy-based activities Navigational infrastructure 35,812 36,349 36,894 37,447 Environmental marine protection 35,961 36,941 37,038 37,594 Seafarer and ship safety 53,986 54,760 55,568 56,359 Total levy-based activities estimate 125,759 127,600 129,500 131,400 Fee-based activities Fees under Navigation Act 2012 and Shipping Registration Act 1981 3,709 3,600 3,700 3,800 Fees for national system 3,856 3,659 3,423 3,479 Total fee-based activities estimate 7,565 7,259 7,123 7,279 Total regulatory charging estimates 133,324 134,859 136,623 138,679 3.3.3 Review of charging structures

AMSA is currently at the start of a comprehensive all-inclusive review of its regulatory charging activity mechanisms, structures and rates. The following specific items have been identified as commencing, or will commence within the next couple of financial years:

- Develop a zero-based and activity-based budget for 2020–21, which will allow the costing model to be refined, using a bottom-up approach to AMSA’s regulatory charging activities. This exercise will list business processes for service delivery, rank these processes, identify resources required for delivery, align costs to activities, set a procedure for the allocation of corporate support functions, and develop key performance indicators for consultation with external stakeholders.

- Portfolio Charging Review, which is a legislative evaluation exercise conducted at least every five years by Departments of State. It will encompass all AMSA’s existing regulatory charging activities, as well as the potential for charging new (or discontinuing current) activities in the provision of goods and regulatory activities to the non-government sector.

- Assess levy cost-drivers to approximate levels of resources used in producing the activity output, with the expectation to demonstrate a linkage between the level of effort and the output. This work is currently in progress, with initial findings indicating that net tonnage may be an appropriate driver of effort. However, work is still being undertaken to finalise AMSA’s conclusions, and will include stakeholder consultation on any proposed changes.

- Assess whether fee-based activity outputs are being delivered in the most effective and efficient way, at minimal costs, and whether industry can fully absorb efficient costs of service delivery.

- Review hourly and fixed rates of fee-based activities under the Navigation Act 2012, Shipping Registration Act 1981, and the National System for Domestic Commercial Vessels. Where similar personnel, expertise, and services are being provided charge-out rates should align.

- Investigate an indexation strategy (if applicable) on regulatory charging activities, reducing the need to regularly revise charge-out rates and reduce inflationary pressures on costs.

- Work with industry and government on an agreed level of maintenance and utilisation of regulatory charging reserves to fund specific requirements.

- National system review of operating costs and funding structures, scheduled to commence in 2020–21. This will include extensive stakeholder consultation on service delivery models and will provide an opportunity to address concerns raised during previous consultation rounds.

AMSA will engage widely and extensively with stakeholders providing opportunities for feedback and comments, with provisions to address industry concerns. An ongoing stakeholder engagement strategy will be prepared.

- 4 Risk assessment

AMSA has implemented internal controls to ensure that costs recovered for regulatory charging activities are measured correctly and are collected on time. In adherence with legislative obligations, an officer of Customs may detain a vessel at any Australian port for any unpaid and outstanding levies, released only after payment is received. This process ensures that the existence of any unpaid levies are consistently at a very low level.

An assessment of regulatory charging activities was conducted using a Department of Finance Charging Risk Assessment. AMSA considers the risk to remain low given no anticipated changes (other than indexation) to current activities in 2019–20.

An examination of identified risks for regulatory charging activities and accompanying mitigation strategies, are detailed in Table 9 below, with additional details provided in AMSA’s Corporate Plan.

Table 9: Risks and mitigation strategies associated with regulatory charging

Risk identified Mitigation strategy Economic factors that may affect the quantity of arriving international commercial vessels AMSA has the capability to implement a range of efficiency measures within a medium timeframe to offset any potential reductions in levy revenue, while maintaining rates at or near current levels. Failure as a regulator to prevent an incident or fatality in relation to compliance and enforcement arrangements Continue to review measures to minimise the risks of shipping and pollution incidents and maximise safety of people involved. This includes ensuring ship inspection programs navigational services and safety and regulatory targets are being met, assessed on a risk-based approach, while implementing and applying lessons learnt. Pollution incident response clean-up costs exceed reserves; financial and reputational damage Implementation of a Pollution Response Reserve to fund any potential clean-up costs from a major environmental emergency; with the possibility to temporarily increase levy or seek a drawdown for a special appropriation should an extreme pollution incident occur. Escalating costs to provide regulatory activities to principle stakeholders beyond efficient costs AMSA forecasts expected levels of demand for regulatory charging activities as part of its annual budgeting process. It intends to carry out benchmarking comparisons with domestic and international regulatory bodies that provide similar charging activities.

Activities and business processes for regulatory charging are constantly monitored and adjusted to align with service deliverables and to identify potential efficiencies, such as information technology changes, that may be implemented to reduce or, at the very least, maintain current costs.

Capital funding shortfalls for the replacement and maintenance of aids of navigation and information technology infrastructure systems AMSA reviews its capital assets periodically and is currently strengthening asset management framework by developing a long term Capital Management Plan, which will enable a comprehensive determination of asset and capital requirements, including maintenance timing, and any potential shortfalls that may exist in capital funding in forward years.

- 5 Stakeholder engagement

Communication with stakeholders is an essential part of developing the CRIS, with adherence to AMSA’s Statement of Regulatory Approach.

AMSA published a consultative CRIS on its website and invited specific industry groups and participants to comment on its cost recovery arrangements. The consultation period was over three-weeks, commencing on 16 October 2019 and concluding on 10 November 2019. Industry groups invited to participant in providing feedback included, Domestic Commercial Vessel Industry Advisory Group, Fishing Industry Advisory Group, Shipping Australian Limited, Ports Australia, and Maritime Industry Association – feedback was encouraged.

Key items raised by stakeholders during this consultation period were:

- Financial language used in CRIS is difficult to understand.

- Perceived opinion of not receiving value-for-money in services provided.

- Incorporate within costing models and report on what efficiency measures have been put into place and what efficiency measures are proposed in reducing high staff costs, such as use of IT and technological systems.

- Clearer distinction between domestic and international commercial shipping activities.

- Greater transparency on financial arrangements associated with participation at IMO and regional forums.

- Pursuit of Australia’s national interest at the IMO should be funded by the taxpayer, rather than industry.

Following the consultative period, AMSA responded appropriately.

AMSA is exploring options to implement a specific ongoing cost-recovery external stakeholder engagement strategy that will include performance measures and will involve initial consultation as part of the National System review from 2020–21. Feedback from this process will inform AMSA of potential funding options, which will eventually be put forth to Government for consideration.

- 6 Financial estimates

Table 10 outlines the financial estimates that AMSA’s expects to achieve for regulatory charging activities for 2019-20 (Budget) and the three following years. Revenue should be read in conjunction with revenue estimates (Section 3.3.2).

Table 10: Financial estimates for regulatory charging activities

2019–20

($’000)

2020–21

($’000)

2021–22

($’000)

2022–23

($’000)

Total

($’000)

Navigational infrastructure Expenses (X) 36,868 36,601 36,805 36,965 147,239 Revenue (Y) 35,812 36,349 36,894 37,447 146,502 Balance (Y - X) (1,056) (252) 89 482 (737) Cumulative balance (1,056) (1,308) (1,219) (737) Environmental marine protection Expenses (X) 34,901 34,648 34,841 34,992 139,382 Revenue (Y) 35,961 36,941 37,038 37,594 147,084 Balance (Y - X) 1,060 1,843 2,197 2,602 7,702 Cumulative balance 1,060 2,903 5,100 7,702 Seafarer ship safety under Navigation Act 2012 and other Acts Expenses (X) 36,202 35,940 36,139 36,297 144,577 Revenue (Y) 53,986 54,760 55,568 56,359 220,673 Balance (Y - X) 17,784 18,820 19,429 20,062 76,096 Cumulative balance 17,784 36,605 56,033 76,096 Marine services under Navigation Act 2012 and ship registration Expenses (X) 6,474 6,428 6,463 6,491 25,857 Revenue (Y) 3,709 3,600 3,700 3,800 14,809 Balance (Y - X) (2,766) (2,828) (2,763) (2,691) (11,048) Cumulative balance (2,766) (5,593) (8,356) (11,048) Marine services for national system Expenses (X) 6,902 6,852 6,890 6,920 27,564 Revenue (Y) 3,856 3,659 3,423 3,479 14,417 Balance (Y - X) (3,046) (3,193) (3,467) (3,441) (13,147) Cumulative balance (3,046) (6,239) (9,706) (13,147) Total regulatory charging Expenses (X) 121,347 120,468 121,138 121,665 484,618 Revenue (Y) 133,324 134,859 136,623 138,679 543,485 Balance (Y - X) 11,977 14,391 15,485 17,014 58,866 Cumulative balance 11,977 26,367 41,852 58,866 As noted, AMSA’s financial estimates do not include levy-based seafarer and ship safety under the National System for domestic commercial vessels. Given the upcoming review of National System operating costs and funding options scheduled for 2020–21, it is not possible to comment on forward years with any degree or level of accuracy. To do otherwise would be confusing and counterproductive.

- 7A Financial performance

Table 11 outlines the historical financial performance of AMSA’s regulatory charging activities.

Reinstated figures for 2013–14 to 2017–18 to align with tables presented in the Australian National Audit Office performance audit - application of cost recovery principles.

Table 11: Historical performance of AMSA’s regulatory charging activities

2013–14

($’000)

2014–15

($’000)

2015–16

($’000)

2016–17

($’000)

2017–18

($’000)

2018–19

($’000)

Navigational infrastructure (Marine Navigation Levy) Expenses (X) 36,244 35,264 34,580 41,134 31,874 35,567 Revenue (Y)* 31,354 32,314 32,993 34,091 34,651 36,539 Balance (Y - X) (4,890) (2,950) (1,587) (7,043) 2,777 972 Cumulative (4,890) (7,840) (9,427) (16,470) (13,693) (12,721) Environmental marine protection (Protection of the Sea Levy) Expenses (X)** 34,871 32,795 34,654 29,128 30,219 62,707 Revenue (Y)* 39,253 31,268 37,259 34,068 36,494 39,234 Balance (Y - X) 4,382 (1,527) 2,605 4,940 6,275 (23,474) Cumulative 4,382 2,855 5,460 10,400 16,675 (6,799) Seafarer ship safety under Navigation Act 2012 and other Acts (Regulatory Functions Levy) Expenses (X) 35,199 46,501 44,781 38,218 43,142 35,507 Revenue (Y) 46,315 48,349 49,266 51,211 52,488 53,470 Balance (Y - X) 11,116 1,848 4,485 12,993 9,346 17,963 Cumulative 11,116 12,964 17,449 30,442 39,788 57,751 Marine services under Navigation Act 2012 and ship registration Expenses (X) 7,136 5,823 5,632 10,891 5,560 5,995 Revenue (Y) 4,111 3,658 4,631 4,849 3,959 3,813 Balance (Y - X) (3,025) (2,165) (1,001) (6,042) (1,601) (2,182) Cumulative (3,025) (5,190) (6,191) (12,233) (14,459) (16,016) Marine services for National System Expenses (X) - - - 625 867 6,359 Revenue (Y) - - - 73 119 3,360 Balance (Y - X) - - - (552) (748) (2,999) Cumulative - - - (552) (1,300) (4,299) Total regulatory charging Expenses (X)** 113,450 120,383 119,647 119,996 111,662 146,135 Revenue (Y)* 121,033 115,589 124,149 124,292 127,710 131,416 Balance (Y - X) 7,583 (4,794) 4,502 4,296 16,048 (9,719) Cumulative 7,583 2,789 7,291 11,587 27,636 17,917 * Revenue includes insurance recoveries for aids to navigation assets and environmental emergency pollution responses. There is a delay in incurring expenditure associated with operational costs, which occurs immediately after an incident, and any eventually recovery, which may take up to six years.

** Expenses in 2018-19 for environmental marine protection includes a $27.1 million provision for clean-up operation costs from a pollution response incident that occurred in June 2018.

As at 30 June 2019, the cumulated balance for regulatory charging activities from 2013-14 to 2018-19 is $17.9 million. After netting off the under-recovery for fee-based and navigational infrastructure activity outputs against the over-recovery of seafarer and ship safety, this balance has been used in part fund the development and implementation of a modern regulatory infrastructure framework applicable for both international and domestic commercial vessels.

- 7B Non-financial performance

Summarised performance targets for regulatory charging activities are provided in Table 12, with specific details contained in Corporate Plan.

Table 12: Performance targets for 2019-20

AMSA has consistently achieved the majority of its performance targets. The results of non-financial performance is reported in its 2019-20 Portfolio Budget Statement and Annual Report.

Although not specific to regulatory charging, AMSA also reports on non-financial performance of National System customer satisfaction, which indicates the level of customer satisfaction with the service delivery by the call centre, and whether their issue was resolved adequately.

AMSA will develop more robust non-financial performance measures specific to regulatory charging activities as part of the National System review in 2020-21, which will include an extensive stakeholder engagement and consultation.

- 8 Key forward dates and events

Indicative dates for the updating tasks of the next cost recovery are disclosed in Table 13.

Table 13: Indicative events and forward dates

Event Description Indicative due date 2020-21 CRIS (budget) Commence development of cost recovery model, including initial stakeholder engagement strategy January 2020 Present model and consultative CRIS to Executive and Board February 2020 Engage actively with external stakeholders, including both Portfolio Department and Department of Finance March 2020 Update model following external stakeholder feedback and addressing issues raised April 2020 Ministerial engagement and upload 2020-21 CRIS onto website June 2020 2020-21 CRIS (update financial performance) Update model with actual results for 2019-20 and obtaining Portfolio approval for the CRIS July 2020 Engage with external stakeholders seeking feedback on changes August 2020 Ministerial engagement and upload CRIS onto website December 2020

- CRIS approval and change register

CRIS approval and change registers from 2016-17 to 2019-20 are provided in Tables 14A to 14C.

This will be updated once the 2019-20 CRIS is approved and published

Table 14A: CRIS for National System introductory fee-based activities (prior to incorporation into 2018-19 consolidated CRIS)

Date of change CRIS change Approval Basis for change 15 Sep 2016 Approval of CRIS Minister for Infrastructure, Transport and Regional Development 23 Sep 2016 Publication of CRIS on website for National System introductory fee-based activities Chief Executive Officer Initial release Table 14B: CRIS for National System full service delivery fee-based activities (prior to incorporation into this consolidated CRIS)

Date of change CRIS change Approval Basis for change 15 Jun 2018 Approval of CRIS Chief Executive Officer 27 Jun 2018 Approval of CRIS Minister for Infrastructure, Transport and Regional Development 27 Jun 2018 Publication of CRIS on website for National System full service delivery of fee-based activities, prior to charging the non-government sector Chief Executive Officer Initial release Table 14C: CRIS approval and change register

Date of change CRIS change Approval Basis for change 29 Jun 2017 Publication of 2016-17 CRIS on website with updated budget (2016-17) and actual results (2015-16) Chief Executive Officer Updated with financial results 21 Dec 2018 Publication on website of 2018-19 CRIS with updated budget (2018-19) and actual results (2017-18), incorporating National System introductory fee-based activities (Table 14A) Chief Executive Officer Updated with financial results and incorporating National System introductory fee-based activities 20 Dec 2019 Publication on website of 2019-20 CRIS with updated budget (2019-20) and actual results (2018-19), incorporating National System full-service delivery fee-based activities (Table 14B) Chief Executive Officer Updated with financial results and incorporating National System full-service delivery fee-based activities

- Appendix 1: Activity based costing methodology

Methodology

The methodology for modelling AMSA’s costs is summarised in the illustration below. It adheres to activity based costing principles, which enables more analysis on the efficiency of activity outputs and/or business processes for cost recovery and other activities. It focuses on cost drivers, which allocates indirect costs to direct costs and then to an output.

There are five principles that support the methodology:

-

- Linked to strategic business planning: costing is not just a ‘bean counting’ exercise. It should be linked to the strategic direction and planning of AMSA and inform the Executive at a strategic and tactical level.

- Holistic approach: a modelling exercise should include all revenue and operating expenditure, including overheads, other indirect costs, and capital expenditure (capital allowances and/or depreciation), where appropriate. Further, it should focus not just on cost recovery activities, but all activities. This will result in a model that can fulfil multiple demands for costing information.

- Comprehensive and consistent: a simple approach that applies consistency in the application of modelling rules across all business areas and activities creates a robust model understood by stakeholders. The development of AMSA’s costing model should occur over a short timeframe with relatively small inputs of resources.

- Flexible: it is important to recognise that demands for service delivery change over time, driven by various internal and external circumstances. A costing exercise must be dynamic in nature to evolve with changes to business requirements and circumstances.

- Institutionalised as a ‘normal’ function: modelling should be a living database that requires regular updating on a periodic basis. This is successful when the model receives official endorsement with wide stakeholder involvement (internal operational unit, as well as external stakeholder ‘buy-in’). Costing will then become a routine task and a ‘foundation stone’ for improving and reporting on financial performance.

-

- Appendix 2: Schedule of fee-based charges

Current schedule of the fee-based regulatory charging activities are listed below, with references to Australian Maritime Safety Authority Fees Determination 2015 and Marine Safety (Domestic Commercial Vessel) National Regulation 2013.

Charge

Type

2018-19

Rate

2019-20

Rate

Services to seafarers and coastal pilots under Navigation Act 2012 Examinations and assessments Assessment of sea service for an:

- certificate of competency as master, deck office or engineer, or

- certificate of recognition of a certificate of competency as master, desk office or engineer.

Fixed fee $168 $168 Oral examination for certificate of competency - STCW 78 unlimited Fixed fee $544 $544 Computer based examination for certificate of competency Fixed fee $220 $220 Assessment of marine qualifications for immigration purposes Fixed fee $472 $472 Undertaking a psychometric assessment Variable External provider cost Written examination of theory or charts for coastal pilot’s licence—standard examination Fixed fee $544 $544 Written examinations of charts for coastal pilot’s licence— Whitsundays Fixed fee $816 $816 Oral examination for check pilot licence Fixed fee $816 $816 Certificates for seafarers and pilots Initial issue of certificate of competency or proficiency Fixed fee $190 $190 Initial issue of certificate of recognition or competency or proficiency or certificate of equivalence Fixed fee $190 $190 Revalidation of certificate of competency o certificate of recognition or proficiency or certificate of equivalence Fixed fee $136 $136 Endorsements to active certificate of competency Fixed fee $112 $112 Initial issue of, or revalidation of, Global Maritime Distress and Safety System (GMDSS) competency certificate or certificate of recognition of GMDSS certificate Fixed fee $112 $112 Issue of initial coastal pilot’s licence of reissue of coastal pilot’s licence Fixed fee $150 $150 Issue of compass adjuster licence Fixed fee $190 $190 Issue of certificate of safety training Fixed fee $112 $112 Issue of certificate of proficiency as Marine Cook Fixed fee $112 $112 Additional charge for transmission of documents other than by regular mail, such as fax, email, or registered mail:

- within Australia

- outside Australia

Fixed fee $40

$80

$40

$80

Inspections and surveys under Navigation Act 2012 Vessel design and performance—tonnage measurements and load line Provision of copies of tonnage calculations Hourly rate $272 $272 Inspections and certification for tonnage measures and load line Hourly rate $272 $272 Inspections of vessels and equipment Approvals and exemptions for a vessels, materials handling equipment or loading or unloading arrangements for a vessel, and, for second and subsequent visits, inspections of vessels, equipment, or arrangements for these matters Hourly rate $272 $272 Survey for initial issue or reissue of a certificate Hourly rate $272 $272 Follow-up visits to re-inspect deficiencies identified at initial inspections Hourly rate $272 $272 Other services and inspections of vessels and equipment Hourly rate $272 $272 Cargo inspections and approvals Visits to vessels or loading facilities for inspections to ensure safe loading and stowage of grain Hourly rate $272 $272 Inspections, determinations, approvals, and exemptions for solid bulk cargoes Hourly rate $272 $272 Inspections, determinations, approvals, and exemptions for dangerous goods Hourly rate $272 $272 Inspections, certifications, approvals, and exemptions for transportation of livestock, including inspections and services for issue or endorsement of an Australian Certification for the Carriage of Livestock Hourly rate $272 $272 Inspections and approvals of containers for authorisations to load or unload where container is unsafe or overloaded or lacking a valid safety certificate plate or after expiry of the examination date Hourly rate $272 $272 Miscellaneous inspections that are compulsory, requested by the recipient, or follow-up inspections to confirm corrective action Hourly rate $272 $272 Other marine services under Navigation Act 2012 Determinations, declarations, exemptions and approvals Determination (other than a manning level determination), declaration, exemptions, or approval Hourly rate $272 $272 Services relating to manning levels Determination of manning levels Fixed rate $1,088 $1,088 Review existing approved manning levels Fixed rate $544 $544 Services relating to the international safety management code Document of compliance or safety management certificate, including conduct initial audit or for reinstatement of document or certificate Hourly rate $272 $272 Scheduled periodic compliance audit relating to continuation of document of compliance or safety management certificate Hourly rate $272 $272 Services to pilotage providers and coastal pilotage exemptions Licence as provider of coastal pilotage services or for reinstatement Hourly rate $272 $272 Scheduled compliance audit of accredited provider of coastal pilotage services Hourly rate $272 $272 Exemption of vessel from coastal pilotage requirements Hourly rate $272 $272 Exemption of seafarer from coastal pilotage requirements for exempt vessel Fixed rate $136 $136 Services to registered training organisations Approval of training course Hourly rate $272 $272 Schedule periodic compliance audit of approved courses provided by registered training organisation Hourly rate $272 $272 Services to providers of vessel traffic services Authorisation to provide vessel traffic services Hourly rate $272 $272 Conduct scheduled periodic compliance audit of provider of authorised vessel traffic services Hourly rate $272 $272 Shipping registration Applications for registration or re-registration Registration of ship required to be registered Fixed fee $2,664 $2,664 Registration of ship, other than Australian owned ship, on demise charter to an Australian based operator Fixed fee $3,996 $3,996 Registration of ship permitted to be registered, other than foreign owned ship on demise charter to an Australian based operator Fixed fee $1,554 $1,554 Transfer or transmission of ownership Registration of transfer, transmission of ownership, for ship required by to be registered Fixed fee $777 $777 Registration of transfer, transmission of ownership, for ship on demise charter to Australian based operator other than an Australian owned ship Fixed fee $1,332 $1,332 Registration of transfer, transmission of ownership, for ship permitted to be registered, other than foreign owned ship on demise charter to an Australian based operator Fixed fee $444 $444 Grant of certificate New registered certificate Fixed fee $222 $222 Provisional registration certificate Fixed fee $333 $333 Extension of period of currency of provisional certificate Fixed fee $222 $222 Grant of temporary pass Fixed fee $333 $333 Certificate of entitlement to fly Australian national flag or red ensign Fixed fee $222 $222 Supply deletion certificate Fixed fee $111 $111 Administrative services Exemption from registration Fixed fee $666 $666 Request for change of name of registered ship Fixed fee $111 $111 Request for change of home port of registered ship Fixed fee $111 $111 Request for extension of time for lodging documents Fixed fee $167 $167 Additional charge for transmission of documents other than by regular mail, such as fax, email, or registered mail:

- within Australia

- outside Australia

Fixed fee $40

$80

$40

$80

Inspections and searches Search by staff of Australian Shipping Registration Office of register - for each period of 15 minutes or remaining part Fixed fee $55.50 $55.50 Certified extract of register or of document forming part of or associated with Register Fixed fee $75 $75 Certified copy of register entry Fixed fee $40 $40 Certified copy of documents forming part of or associate with register - for each page Fixed fee $21 $21 Caveats Lodgement of a caveat Fixed fee $222 $222 Services relating to a continuous synopsis record New continuous synopsis record Fixed fee $555 $555 Reissue of continuous synopsis record Fixed fee $170 $170 Amendments to existing continuous synopsis record Fixed fee $390 $390 Certificate of survey under National System*^ Certificate of survey New certificate of survey Fixed fee $366 $370 Renew an existing certificate of survey Fixed fee $206 $208 Vary an existing certificate of survey# N/A - - Voluntarily suspend a certificate of survey Fixed fee $208 $210 Replace a certificate of survey Fixed fee $37 $37 Unique vessel identifier Unique vessel identifier Fixed fee $159 $161 Certificate of operation under National System*^ Certificate of operation New certificate of operation Fixed fee $194 $196 Renew an existing certificate of operation Fixed fee $194 $196 Vary an existing certificate of operation Fixed fee $181 $183 Voluntarily suspend a certificate of operation Fixed fee $208 $210 Replace a certificate of operation Fixed fee $37 $37 Certificate of competency under National System*^ Examinations and assessments Conduct an examination Fixed fee $326 $344 Certificates of competency – near coastal New certificate of competency – near coastal for:

- Coxswain grade 1

- Coxswain grade 2

- General purpose hand

- Marine engine driver grade 2

- Marine engine driver grade 3

- Master inland waters

- Master less than 24 metres

Fixed fee $151 $152 New certificate of competency – near coastal for:

- Engineer class 3

- Marine engine driver grade 1

- Master less than 35 metres

- Master less than 80 metres

- Mate less than 80 metres

Fixed fee $259 $262 Renew an existing certificate of competency – near coastal for:

- Coxswain grade 1

- Coxswain grade 2

- General purpose hand

- Marine engine driver grade 2

- Marine engine driver grade 3

- Master inland waters

Fixed fee $138 $139 Renew an existing certificate of competency – near coastal for:

- Engineer class 3

- Marine engine driver grade 1

- Master less than 35 metres

- Master less than 80 metres

- Mate less than 80 metres

Fixed fee $219 $221 Vary an existing certificate of competency (i.e. remove a restriction, add an endorsement, change of name) Fixed fee $138 $139 Replace a lost, stolen or destroyed certificate of competency Fixed fee $138 $139 Other marine services under National System* Accreditation application fees 1 to 5 categories of surveying Fixed fee $1,445 $1,445 6 to 10 categories of surveying Fixed fee $2,216 $2,216 11 to 16 categories of surveying Fixed fee $2,986 $2,986 Renew existing marine surveyor accreditation Fixed fee $263 $263 Replace lost, stolen or destroyed accreditation card^ Fixed fee $48 $48 Vary an existing accreditation^ Fixed fee $271 $274 National Law exemptions Scheme non-survey (Exemption 2)^ Fixed fee $183 $185 Operation beyond survey time (Exemption 6)^ Fixed fee $224 $226 Temporary operations permit (Exemption 7)^ Fixed fee $289 $292 Class C restricted operations (Exemption 40)^ Fixed fee $315 $319 Exemption from the application of the National Law or specified provisions of the National Law Hourly rate $238 $241 Approval under a Marine Order or an equivalent means of compliance Hourly rate $238 $241 Other items Other services not listed elsewhere Hourly rate $272 $272 * National System fee-based activities are subject to annual indexation, calculated in accordance with the Regulation. For 2019-20, an indexation factor of 1.3% is applied, effective from 1 July 2019.

^ These fee-based activities were included in a separate Cost Recovery Implementation Statement of National System for Domestic Commercial Vessel in June 2018.

# From January 2019, a decision was made to no longer charge industry for this fee-based activity.