Cost recovery involves government entities charging individuals or non-government organisations some or all of the efficient costs of a regulatory charging activity. This may include goods, services, or regulation, or a combination of them. The Australian Government Charging Framework, which incorporates the Cost Recovery Guidelines (the CRGs)1, sets out the framework under which government entities design, implement and review regulatory charging activities.

- 1. Introduction

1.1 Purpose of Cost Recovery Implementation Statement

This Cost Recovery Implementation Statement (CRIS) provides information on how the Australian Maritime Safety Authority (AMSA) implements cost recovery for provision of infrastructure, regulation to support safe ship navigation in Australian waters, marine environmental protection, seafarer and ship safety, ship registration, and related marine services under the Navigation Act 2012 and Marine Safety (Domestic Commercial Vessel) National Law Act 2012. It contains financial estimates for 2019-20 and budget forecasts for 2020-21 and the three following years.

This document provides key information on the application of cost recovery activities, including financial and non-financial performance. It assists stakeholders to understand AMSA’s costs, which strengthens accountability, provides transparency, and demonstrates compliance with CRGs and the Regulatory Charging General Policy Order.

1.2 Description of the regulatory charging activity outputs

1.2.1 Policy background

AMSA’s policy outcome is to ‘minimise the risk of shipping incidents and pollution in Australian waters through ship safety and marine environment protection regulation, and to maximise people saved from maritime and aviation incidents through search and rescue coordination2.

1.2.2 Description of the activities

Regulatory charging activity outputs are summarised in Table 1, with the funding mechanism contained in brackets.

Table 1: Descriptions of AMSA’s regulatory charging activity outputs

Activity output Description Navigational infrastructure (Marine Navigation Levy) Maintain a national network of integrated aids to navigation (AtoN) and traffic management measures in Australian waters3 to ensure safe and efficient coastal navigation of the commercial shipping industry. This includes the provision of technical maintenance and engineering project management services.

Other activities include shaping and ensuring appropriate international maritime standard setting at:

- International Maritime Organization (IMO), such as Australia’s obligations under International Convention for the Safety of Life at Sea (SOLAS), and

- International Association of marine aids to navigation and Lighthouse Authorities (IALA).

Environmental marine protection (Protection of the Sea Levy) Resources the National Plan for Maritime Environmental Emergencies (National Plan), which is a cooperative arrangement between the Commonwealth, States and Northern Territory, and commercial shipping industry.

The National Plan details processes about pollution response incidents including:

- funding arrangements for clean-up operation costs relating to ship sourced pollution, and

- pollution that cannot be attributed to any specific vessel or cannot be wholly recovered from insurance providers.

Another primary function is funding the National Maritime Emergency Response Arrangements, as well as the maintenance of preparedness to combat pollution by ensuring there is adequate capability to respond to incidents through:

- training of personnel in response techniques,

- acquisition, maintenance, and stockpiling of relevant equipment and supplies at key sites around Australia, and

- provision of emergency towage capability.

Seafarer and ship safety under Navigation Act 2012 and other Acts (Regulatory Function Levy) Conduct a range of maritime safety and regulatory activities on international and national commercial shipping operations. This consists of compliance inspections and audits undertaken on a risk based sample approach.

A fundamental component of the activity is port State control inspections, which are inspections to ensure vessels and their owners or operators comply with regulations relating to vessels, crew, and the marine environment.

Other inspections and audits include:

- flag State control inspections,

- marine surveys,

- cargo and handling related inspections,

- marine qualification duties and accreditations, and

- audits of registered training organisations.

Promoting a culture of safety in the maritime industry through development of policies, guidelines, and technical requirements (Marine Orders) relating to legislative functions, is an integral component of the activity output.

Seafarer and ship safety also includes the development of Australia’s maritime regulations and participation in international and regional maritime forums. It involves developing international standards on seafarer and ship safety and environmental protection, including harmonisation to international standards, mainly promulgated by the International Maritime Organization (IMO), International Labour Organization, and members of the Tokyo and Indian Ocean Memoranda of Understandings for port State control.

Marine services Navigation Act 2012 and ship registration under Shipping Registration Act 1981 (fee-based activity under Fee Determination) Provides a range of fee-based activities:

- services to seafarers and coastal pilots (mainly qualifications), including approvals, issuing permits, authorisations, certifications, conducting examinations, and licensing for domestic and internationally recognised marine qualifications,

- inspections and surveys requested by ship owners (or agents),

- shipping registration of Australian flagged vessels, including ensuring vessels are maintained and crewed to a suitable standard, and

- other services, including determinations and exemptions.

Marine services under National System for domestic commercial vessels (fee-based activity under National System Regulations) From 1 July 2018, AMSA transitioned to deliver safety services for domestic commercial vessels and seafarers, previously delivered by the States and Northern Territory agencies.

As part of transitional funding arrangements, regulatory function based activities continue to be government funded, with fee-based activities cost recovered from industry.

The fee-based activities provided are:- certificates of operation, including assessment of application and issuing approvals for vessels to operate within certain defined areas and purposes,

- certificates of survey, including assessment of applications, and issuing approvals and certificates, to operate as a commercial vessel ensuring vessels comply with Australian law and standards,

- seafarer certificates of competency – near coastal, including approvals, assessing revalidations, issuing certifications, and conducting examinations for recognised marine qualifications,

- marine surveyor accreditation scheme to monitor and maintain competency of the network of accredited surveyors in the non-government sector, and

- assessment of applications requesting exemptions from standards and regulation of the National System or equivalent means of competency.

This CRIS does not cover:

- Regulatory activities of the National System for domestic commercial vessels. On 2 July 2018, the Australian Government announced an additional $10 million funding to delay charging levies to industry for the first three years of service delivery. These activities will continue to be funded by a combination of Commonwealth appropriations and by States and Northern Territory jurisdiction contributions - total funding by all governments is now $112.4 million over ten years. The additional time will enable AMSA to engage with industry on a range of matters and address industry concerns, including:

- most effective and efficient way to deliver services, and

- opportunities to reduce costs and administrative burden, without compromising safety. National System operating costs and funding will undergo a review, and include extensive stakeholder consultation on service delivery.

- Commercial charges for the sale of publications (task, record, and logbooks), attachment licensing to third parties to use aids to navigation sites for specific purposes, and sub-leasing office and storage space.

- Search and rescue coordination services for maritime and aviation incidents, which are funded by government budget appropriations4.

- Funding arrangements of shipping and offshore petroleum industries and the International Oil Pollution Compensation (IOPC) fund5, and

- Externally funded programs sponsored by various government departments for the provision of specific maritime related services.

1.2.3 Appropriateness of cost recovery

It is government policy that when an individual or organisation creates a demand for a government activity, there should generally be a charge for the provision of these activities.

Participants in the commercial shipping industry pay the costs attributable to the provision of navigational infrastructure within Australian waters, marine environmental protection, seafarer and ship safety, marine services under the Navigation Act 2012, ship registration, and some services under the National System for domestic commercial vessel safety.

Regulatory functions in many instances may be applicable across AMSA’s various activity outputs, such as emergency towage capability and work health and safety. Over time, a clearer demarcation of the costs to be borne by industry will be better understood.

Government policy is not to charge a levy for National System for domestic commercial vessel activities until a regulatory review is undertaken, assessing costs, funding options, and reducing administrative burden to industry.

Further, Government continues to funds search and rescue services attributable to community service obligations to the broader community through budget appropriations.

1.2.4 Stakeholders

The principle stakeholders for AMSA’s regulatory charging activity outputs are:

- vessel owners and operators, and their associated agents – international vessels (~5,800) and domestic commercial vessels (~27,000),

- seafarers and coastal pilots – international (~60,000) and domestic (~66,000),

- accredited marine surveyors (~250),

- registered training organisations,

- Commonwealth, State and Northern Territory agencies, and

- the Australian community.

1. The Australian Government Charging Framework and the Cost Recovery Guidelines are available on the Department of Finance website www.finance.gov.au.

2. Department of Infrastructure, Transport, Regional Development and Cities, Portfolio Budget Statement 2019-20, Budget Related Paper No. 1.12, page 80.

3. AMSA does not provide navigational aids within port boundaries; these are the responsibility of port operators.

4. The Government reaffirmed its initial policy, upon the establishment of AMSA in 1991, through the Strategic Review of Search and Rescue Service and pricing study in 2001 that search and rescue activities will remain funded from taxpayer funded budget appropriations.

5. The Protection of the Sea (Oil Pollution Compensation Funds) Bill 1992 essentially established the procedure by which entities are required to provide details of oil receipts to the IOPC fund through AMSA - this is not a cost recovery arrangement.

- 2. Policy and statutory authority to recover

2.1 Government policy approval to cost recover regulatory activities

The Explanatory Memorandum of the Australian Maritime Safety Authority Act 1990 states the Government’s intent that AMSA ‘will run on a self-funded basis, with services which cannot be provided on a self-funded basis (search and rescue coordination services) to be paid by the Commonwealth’.

AMSA recovers costs from participants in the commercial shipping industry in adherence with Public Governance, Performance and Accountability (Charging for Regulatory Activities) Order 2017, which refers to the Australian Government Charging Framework and CRGs.

2.2 Statutory authority to charge

AMSA’s regulatory charging activities are authorised by the application of Australian Commonwealth legislative instruments, in particular Part 5, Division 2 of the Australian Maritime Safety Act 1990, which provides for the charging of levies and fees with references to the following Acts:

- Navigation Act 2012

- Marine Navigation Levy Act 1989

- Protection of the Sea (Shipping Levy) Act 1981

- Marine Navigation (Regulatory Functions) Levy Act 1991

- Shipping Registration Act 1981

- Marine Safety (Domestic Commercial Vessel) National Law 2012

A summary by AMSA’s activity outputs of government policy approval to cost recover, including date of approval, and statutory authority to charge with legislative references is included in Appendix 1.

- 3. Cost recovery model

3.1 Outputs and business processes of the regulatory charging activities

3.1.1 Activity outputs

As described in Section 1.2.1, AMSA’s role is to deliver on seafarer and ship safety, and marine environmental protection through regulation, as well as provide search and rescue capability. The broad outputs and primary activities for all roles are itemised in Table 2, which also notes whether the output is subject to regulatory charging (cost recovery) or not.

Table 2: AMSA’s broad activity output listing

Activity output

Primary activities

Regulatory charging?

Search and rescue activities and functions - Operating AMSA Response Centre, coordinating maritime and aviation search and rescue.

- Providing two ground stations and Mission Control Centre for the Cospas Sarsat distress beacon detection system.

- Maintaining maritime distress and safety communications services.

- Providing dedicated airborne search and rescue services.

No, funded by government budget appropriations Navigational infrastructure - Providing and maintaining a national network of marine aids to navigation (AtoN) and related navigational systems and measures.

- Intergovernmental and international engagement to shape and ensure appropriate maritime standards are in place (e.g. for Australia’s obligations under the SOLAS convention and for the provision of AtoN that align with international guidance from IALA).

Yes Environmental marine protection - Managing the National Plan, including crisis preparedness to combat marine environmental emergencies (pollution incidents).

- Regulating, monitoring, and coordinating maritime casualty management and emergency towage capability.

- Conducting pollution prevention public awareness and education campaigns.

Yes Seafarer and ship safety under Navigation Act 2012 and other Acts - Monitoring compliance with operational standards for ships in Australian waters, under the Act, to ensure their seaworthiness, safety and pollution prevention.

- Participating in the development and implementation of national and international marine safety and environment protection standards.

- Providing public access to ship safety and environment protection standards and policies.

- Administering training standards for seafarers and coastal pilots.

- Conducting safety public awareness and education campaigns.

- Exercising occupational health and safety inspectorate functions.

Yes Marine services under Navigation Act 2012 and ship registration under Shipping Registration Act 1981 - Administering certificates of competency for seafarers and coastal pilots.

- Conducting inspections, surveys, and audits requested by ship owners or their agents.

- Administering Australia’s ship registration system.

Yes Marine services under National System for domestic commercial vessels - Assessing applications and issuing approvals and certificates of operation, survey, and competency of near coastal seafarer qualifications.

- Assessing applications and issuing approvals for network of accredited marine surveyors.

- Assessing applications that request exemptions from the application of the National System, and equivalent means of competency.

Yes Seafarer and ship safety under the National System for domestic commercial vessels - Monitoring compliance with standards for the domestic commercial vessel fleet,

- Participating in the development and implementation of domestic marine safety and environment protection standards.

- Conducting safety awareness and education campaigns for domestic commercial vessel industry.

No, funded by combination of government budget appropriations and jurisdiction contributions Externally funded programs - Externally funded programs sponsored by various government departments for provision of specific maritime related services, predominantly in relation to search and rescue capabilities.

No, funded by various government departments Operational targets of activity outputs are contained in the annual report and performance statements of AMSA’s Corporate Plan, which describes the reportable measurements to achieve policy outcomes. A summary of regulatory charging activity non-financial performance measures is in Section 8.

3.1.2 Business processes

Levy-based activities

Levy-based regulatory charging activities relate to the provision of a total function (or statutory regulation) as opposed to transactional business processes; business processes and costs for delivering these activities are not undertaken on a transactional basis. Instead, carried out as an overall activity with output outcomes and non-financial performance targets that aim to minimise the risks of shipping and pollution incidents and maximise safety of people involved.

Fee-based activities

Driven by distinct business processes, fee-based regulatory charging activities support specific regulatory functions to which the fees relate. Generic business processes for AMSA’s fee-based activities include:

- receipt, review, and decision on an application, including ongoing consultation with the applicant,

- undertaking technical assessment, with a decision made by a delegate, and

- processing and issuing a certificate, license, exemption, determination, or approval.

In practice, administrative business procedures for the receipt, review and issue are broadly similar across fee-based charging activities. However, time and effort (and associated costs) for technical assessments and decisions vary between the types of outputs and on the complexity or nature of the application.

3.2 Costs of regulatory charging activities

AMSA applies an activity-based costing methodology to determine costs for activity outputs and regulatory charging activities, as depicted in Appendix 2. This holistic methodology allocates all costs to activity outputs based on estimated time and effort, and associated cost drivers.

3.2.1 Changes in costing model techniques

In developing the 2020-21 budget, AMSA undertook an activity-based costing and zero-based budget exercise to establish a framework that is transparent, defensible, and repeatable. The approach in developing costing models is contained in Appendix 3, including cost drivers, assumptions, and sensitivities.

This exercise provided insights into the functional breakdown of activities and associated costs for activity outputs, developed more accurate cost drivers for corporate related enabling activities, refined appropriate service delivery through ranking of activities, and commenced the process in developing key performance indicators for measurement of an activity’s efficiency and effectiveness. The outcome was an activity-based costing model used to develop the 2020-21 budget and to align costs to source funding.

AMSA is currently engaged in the next stage of its continuous improvement program by mapping key processes, measuring effective service delivery, and analysing costs through benchmarking direct and overhead activities against industry standards to determine efficiency. This will support the upcoming government review of AMSA’s operations and reduce administrative burden and costs to regulated entities, without compromising safety.

3.2.2 Nature of costs

The nature and make-up of costs vary considerably across AMSA’s regulatory charging activity groups. For example, for provision and maintenance of aids to navigation there is an extensive capital cost component (depreciation), with consistently high operational maintenance costs, reflecting the hostile environmental conditions in which these assets operate.

In contrast, compliance and certification activity groups are labour intensive and as such have a high staff cost component. Generally, activities with a large staffing level require a higher proportion of property operating expenditure and ICT overheads compared to activities that have minimal labour inputs.

3.2.3 Cost categories

Direct

Direct costs are those costs directly and clearly attributed to an activity group based on estimations of resource requirements to deliver statutory and regulatory obligations, and include direct operational management support activities – direct costs include employee, suppliers, and depreciation expenditure. AMSA business line managers provided direct input in assigning costs to activities, including staff utilisation to achieve operational outcomes validated by estimated time and effort requirements, and supplier costs based on an analysis and nature of expenditure.

Corporate overheads

Overheads include property operating expenditure, ICT networking, communication costs, and enabling tasks and processes to support service delivery of AMSA’s activity outputs through provision of corporate services and executive functions.

Enabling overheads comprise executive, human resources, finance, governance, and general ICT support – accompanying their respective share of property operating expenditure, ICT networking, and communication costs.

AMSA applies several cost drivers to allocate indirect, support, and corporate overhead costs to direct activity outputs, as detailed in Appendix 3.

Capital costs

Depreciation and amortisation is a representation of capital costs, used to determine capital expenditure requirements for replacement and enhancement of assets. Assessed on an asset-by-asset basis to identify the appropriate treatment, where there is a specific direct link depreciation is assigned to an activity group, whereas corporate support related depreciation is assigned to the appropriate overhead classification.

3.2.4 Cost estimates for 2020-21

Estimated costs for providing AMSA’s regulatory charging activities, broken down into direct average staffing levels (ASL), and direct, overheads, and capital costs is set out in Table 3.

Table 3: Breakdown of costs estimates for 2020-21

Activity output and groups

Direct ASL*

Direct ($’000)

Overheads ($’000)

Capital ($’000)

Total ($’000)

Navigational infrastructure 16.3 23,027 3,669 7,280 33,976 Provision and maintenance of aids to navigation 10.3 18,586 2,676 7,103 28,365 Vessel traffic services (ReefVTS) 0.9 2,604 335 17 2,956 Standards development 2.5 617 303 48 968 Provision of under keel clearance management 0.3 731 95 69 895 Other** 2.3 489 260 43 792 Environmental marine protection 18.8 21,842 3,862 2,117 27,821 National Plan pollution response 17.5 21,617 3,725 2,094 27,436 Other** 1.3 225 137 23 385 Seafarer and ship safety 113.5 33,031 14,074 2,318 49,423 Compliance 33.6 8,885 4,067 694 13,646 Standard development 29.5 7,893 3,635 576 12,104 Integrated operations 16.8 4,609 2,044 329 6,982 Decision support and intelligence 5.3 4,298 903 98 5,299 Education and engagement 9.9 2,840 1,178 177 4,195 Enforcement 8.3 2,014 1,011 166 3,191 Certification 2.1 705 284 106 1,095 Other** 8.0 1,787 952 172 2,911 Marine services & ship registration 26.5 6,989 3,286 779 11,054 Certification 7.9 2,407 1,074 412 3,893 Audit and assurance 8.2 2,160 993 171 3,324 Qualifications 6.4 1,469 746 120 2,335 Ship registration 3.0 531 347 61 939 Other** 1.0 422 126 15 563 Marine services National System 20.8 4,451 2,534 805 7,790 Certification 12.5 2,628 1,594 656 4,878 Qualifications 5.9 1,429 679 105 2,213 Exemptions and approvals 2.4 394 261 44 699 Total for regulatory charging 195.9 89,340 27,425 13,299 130,064 *Direct ASL does not include corporate support or non-regulatory charging activities (such as search and rescue or National System regulatory function output currently funded by government).

** Consists of various activities considered immaterial for reporting purposes.

3.3 Design of regulatory charges

3.3.1 Charging structure

Regulating international and domestic commercial shipping and seafarers is a complex undertaking, with a wide variety of vessel types, crewing levels, competency prerequisites, handling requirements for various cargoes, operational conditions, and jurisdiction and international obligations.

AMSA applies a ‘user pays’ principle for regulatory charging activities. The design of AMSA’s regulatory charging activity outputs considers whether the provision of such regulatory activities is to an individual entity (reasonably attributed to that entity), or to a group of entities (provided to commercial shipping industry and broader community) – where the former, fees are charged, whereas the latter involves levies.

AMSA’s broad charging structure is summarised in Table 4.

Table 4: Charging structure of regulatory activity outputs

Activity output

Charging mechanism

Structure

Levy-based activities Navigational infrastructure Marine Navigation Levy Net registered tonnage – sliding scale Environmental marine protection Protection of the Sea Levy Net registered tonnage – linear Seafarer and ship safety under Navigation Act 2012 and other Acts Regulatory Function Levy Net registered tonnage – sliding scale Fee-based activities Marine services under Navigation Act 2012 and ship registration Fee Determination (fee-based activities) Direct (fixed) fee or hourly rate Marine services under National System National Law Regulation (fee-based activities) Direct (fixed) fee or hourly rate Levy-based activities

AMSA’s methodology for charging levies is derived from historical predecessors, as well as international standards where banding by tonnage is considered common practice for the commercial shipping industry. Levy rates within these bands, are adjusted periodically to address shortfalls or imbalances, with the last change occurring in 2014-15.

International commercial vessels are liable for levies on either (1) the date of arrival to an Australian port, or (2) where the vessel is in Australia waters with no corresponding paid levy applicable for the previous three months, the day after the end of that period. For Australian coastal trading vessels, unless the vessel is out-of-service, levies are payable at the start of each quarter.

The average number of port visits during each levy payment period (three months) varies depending on the vessel type and handling of cargoes, with bulk cargo vessels averaging around one to two visits per levy payment period and container ships around five to six.

The commercial shipping industry pays levies on non-exempted vessels6 that are twenty-four metres or more in tonnage length, with the rate based on a vessel’s net registered tonnage, with environmental marine protection activity output charged on vessels that also carry ten or more tonnes of oil on board7, with a minimum amount payable of $10. AMSA’s levy ready reckoner is in Table 5.

6. There is a list of exemptions contained in the Marine Navigation Levy Collection Regulations 2018, Marine Navigation (Regulatory functions)Levy Collection Act 1991, and Protection of the Sea (Shipping Levy) Regulation 2014.

7. There will be situations where vessels exempted from both the Marine Navigation Levy and Regulatory Function Levy may be liable for the Protection of the Sea Levy. Generally, these vessels include fishing, religious charitable, non-for-profit organisation, or research vessels.

Table 5: AMSA’s levy ready reckoner

Net Registered Tonnage (NRT) From: 0 5,001 20,001 50,001 To: 5,000 20,000 50,000 ∞ Levy* Cents per NRT Cents per NRT Cents per NRT Cents per NRT Marine Navigation Levy 23.50 12.00 7.00 2.50 Regulatory Function Levy 17.00 17.10 17.00 15.50 Protection of the Sea Levy 11.25 11.25 11.25 11.25 Levy calculation method 51.75c for each tonne $2,587.50 plus 40.35c for each tonne over 5,000 $8,640.00 plus 35.25c for each tonne over 20,000 $19,215.00 plus 29.25c each tonne over 50,000 * Schedule of levy rates are contained in each respective levy legislative instruments.

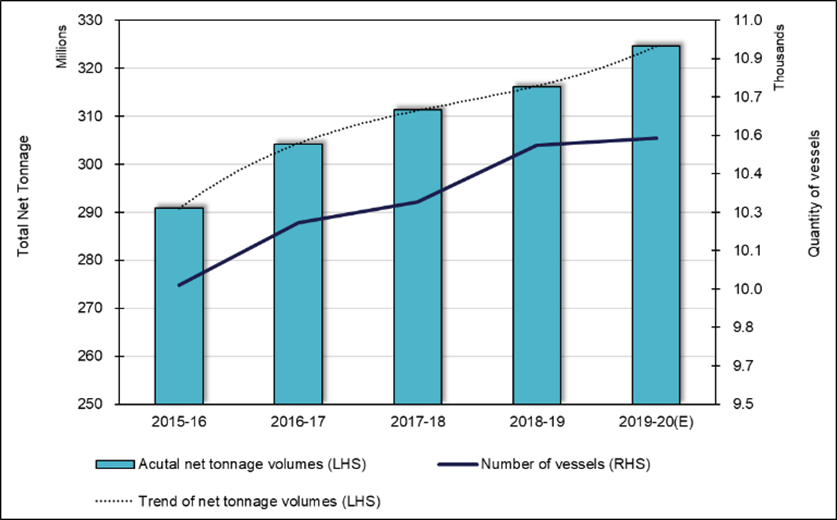

As illustrated in Figure 1, the total number of levy liable visits to Australian ports by applicable foreign-flagged and domestic coastal trading vessels has slowly increased from ~10,000 in 2015-16 to an estimated ~10,500 for 2019-20, while total net registered tonnage volumes (the basis for collecting levies) have risen proportionally more, signifying larger vessels are visiting Australian ports in 2019-20.

Figure 1 – Volumetric data for levy revenue (net tonnage and number of vessels)

The majority of vessel types visiting Australia continue to be bulk cargo carriers, with iron ore and coal vessels contributing ~67% of total net tonnage – which indicates a heavy reliance on iron ore and coal exports.

Despite the steady increase in the quantity and size of international ships visiting Australian ports, shipping usage for aids to navigation, and demand for inspections and other regulatory functions is largely influenced by externalities that may impact volumes year-on-year. These are largely outside the control of AMSA, including the COVID-19 pandemic, potential trade disputes, economic disruptions, and the changing climate.

In relation to environmental marine protection, given the nature and purpose of this activity, it is not possible to ascertain when a marine environmental emergency will occur. When an incident does occur, costs of clean-up operations and financial commitments can be enormous, with legal proceedings often taking years to conclude. While international compensation regimes are generally highly effective, the cost of responding to an incident can exceed the available liability and compensation limits. From evidence of incidents overseas, in these cases governments have had to bear the shortfall, which can be many hundreds of millions of dollars.

These factors mean that any projections of expected growth (or reductions) in demand for regulatory charging activities must consider complex relationships within the commercial shipping industry. AMSA is continuing to develop and rollout risk-based models to provide better insights into the linkage between the level of regulation effort to cost recovered revenue from industry.

Fee-based activities

Fee-based activities include assessment of applications, exemptions and determinations, inspections and surveys, registration of vessels, conducting examinations, and accreditation of non-government service providers.

AMSA applies fixed fees to regulatory charging fee-based activities where the range of typical delivery times do not vary significantly from the standard average time. Where there are wide variations, indicated by significant divergences from the standard deviation, the basis of the relevant charge is an hourly rate, and any reasonable unavoidable travel costs. These travel costs may be flights and accommodation, where provision of services are at locations remote from AMSA’s regional offices8, or motor vehicle travel rates where vehicles are used for the mode of transportation to and from offices9.Marine services and ship registration is tracked using multiple systems, including a Coastal Pilotage System, International Marine Qualifications System, NAVIS (ship registration), MARS (domestic commercial vessels), and Financial Management Information System. Volumes are estimated based on inputs provided by business line managers during the budget development process, using largely historical data obtained from these various systems, and adjusted for expected variances.

A schedule of fee-based regulatory charging activities, separated into fees under the Navigation Act 2012 and fees under National System, is included in Appendix 4. Charging rates are published on AMSA’s website.

3.3.2 Revenue estimates

Revenue estimates for current year (2019-20), budget (2020-21), and the three forward year estimates are summarised in Table 6.

Table 6: Revenue estimates

Estimate

Budget

Forward Year Estimates

Activity outputs 2019-20 ($’000) 2020-21 ($’000) 2021-22 ($’000) 2022-23 ($’000) 2023-24 ($000) Levy-based activities Navigational infrastructure 36,189 36,300 36,800 37,400 38,000 Environmental marine protection 36,335 36,500 37,000 37,600 38,200 Seafarer and ship safety 54,274 54,800 55,600 56,400 57,200 Total levy-based activities 126,798 127,600 129,400 131,400 133,400 Fee-based activities Fees under Navigation Act 2012 and Shipping Registration Act 1981 3,343 3,400 3,400 3,400 3,400 Fees for National System 2,731 3,300 3,300 3,300 3,300 Total fee-based activities 6,074 6,700 6,700 6,700 6,700 Total regulatory charging 132,872 134,300 136,100 138,100 140,100 3.3.3 COVID-19 disruptions and bushfire relief

AMSA is committed to providing relief to the domestic commercial industry from natural disaster disruptions, such as the 2019-20 bushfires, and the COVID-19 pandemic. As part of this commitment, AMSA has implemented:

- exempting vessels used in emergencies such as evacuation of bushfire victims,

- minimum safe crewing requirements and safety management system temporary updates in response to a natural disaster, and

- general exemption for seafarers providing an extension for certificates of competency with expiry dates between from 26 March 2020 to 1 October 2020.

AMSA is also considering other options to reduce stress on operators during this period.

3.3.4 Review of charging structures

AMSA is engaged in a comprehensive all-inclusive review of its regulatory charging activities, structures and rates in anticipation of the upcoming government review. The following specific items are planned to be assessed over the next twelve to twenty-four months:

- Following the activity-based costing and zero-based budget exercise, undertake an analysis of direct processes and corporate overheads to assess efficiency, including benchmarking with external entities.

- Assess levy regulatory drivers to approximate levels of resources used to produce activity outputs, to demonstrate a linkage between the level of effort and the output. Initial findings indicate net tonnage may be an appropriate driver of effort. Work is continuing to finalise AMSA’s conclusions, with any proposed change to involve wide and extensive consultation.

- Assess whether the delivery of fee-based activity outputs at minimal costs is the most effective and efficient way to deliver services, and whether industry can fully absorb the resultant cost of service delivery.

- Review hourly and fixed rates of fee-based activities under the Navigation Act 2012, Shipping Registration Act 1981, and the National System. Where similar personnel, expertise, and services are performed, rates should align.

- Investigate an indexation strategy (if applicable) on regulatory charging activities and the need to regularly revise charge-out rates, to reduce inflationary pressures on costs.

- Work with industry and government on an agreed level of maintenance and utilisation of temporary regulatory charging reserves to fund specific requirements.

AMSA will engage widely and extensively with stakeholders providing opportunities for feedback on any proposed changes, with provisions to address industry concerns. A stakeholder engagement strategy will be prepared for each consultation.

- 4. Risk assessment

AMSA has implemented internal controls to ensure costs recovered for regulatory charging activity outputs are measured correctly and are collected on time. In adherence with legislative obligations, an officer of Australian Border Force may detain a vessel at any Australian port for any unpaid and outstanding levies. The vessel can only be released after payment is received. This process ensures the existence of any unpaid levies are consistently at a very low level.

An assessment of regulatory charging activities was conducted using Department of Finance’s Charging Risk Assessment. AMSA considers the risk to remain low to medium, given no anticipated changes (other than indexation) to current activities in 2020-21. Identified risks, accompanying mitigation strategies and controls, are provided in Table 7 with additional details provided in AMSA’s Corporate Plan.

Table 7: Risks and mitigation strategies associated with regulatory charging

Risk identified

Inherent risk

Mitigation strategy and controls

Residual risk

Funding risk to levies

Levies are collected based on tonnage proxies predominately from the number of arriving international commercial vessels, with the majority of levies (67%) sourced from iron ore and coal bulk cargo.

Economic factors, such as COVID-19 disruptions or a trade dispute, may adversely reduce AMSA’s levy revenue as the number of international vessels arriving at Australian ports decrease. Tonnage (and revenue) may drop quickly in reaction to economic pressures.

In the short-to-medium timeframe, our regulatory service delivery (and associated costs) will remain similar (sticky); as revenue decrease, it may not be enough to cover expenditure on our regulatory functions.

High - Capability to implement a range of efficiency measures within a medium timeframe to offset any potential reductions in levy revenue without need to adjust rates.

- Regularly compare regulatory charging costs against revenue and volumetric data to ensure unit costs are reflective of pricing within each tonnage band.

- Review use of tonnage-based proxies for levies to enable charges to be more reflective and closely linked to level of effort – weighed up against ease of operation and associated costs to administer.

- Work with the Department of Infrastructure, Transport, Regional Development and Communications (Department of Infrastructure) and the Government to consider the appropriateness of levy rates.

Medium Secure funding for National System

National System regulatory-based activities are funded by a combination of government budget appropriations and jurisdiction contributions. Full government funding for functions (except fee-based activities) has been committed to 30 June 2021, with future arrangements expected to be considered through a government review of effectiveness in service delivery and cost efficiency.

AMSA must work with the Department of Infrastructure, Transport, Regional Development and Communications and the Government to ensure sufficient funding for the National System regulatory activities to avoid shortfalls.

Severe - Engage early and regularly with government and industry groups (principle external stakeholders).

- Determine and segregate one-off developmental and transitional costs from business-as-usual costs associated with National System, with the former funded by retained earnings.

- Work with the Department of Infrastructure and Government to consider future funding models and arrangements for the National System following the government review.

Medium Ensure regulated industry are operating to appropriate standards

Failure as a regulator to prevent an incident or fatality in relation to compliance and enforcement arrangements.

High - Continue to review measures to minimise the risks of shipping and pollution incidents and maximise safety of people involved – includes education and training.

- Ensure targets are being met for ship inspection programs, navigational services, and safety and regulatory, assessed on a risk-based approach, while capturing and applying lessons learnt.

Medium Reserves not enough to fund a major pollution incident clean-up

A major environmental emergency pollution incident – defined as exceeding 50,000 litres or 50 tonnes of oil or hazardous waste – resulting in clean-up costs exceeding retained earnings, damaging reputation, and forcing AMSA to seek special appropriation funding from government.

High - Implementation of a $50 million pollution response reserve to fund any potential clean-up costs deemed appropriate for up to a 450-500 tonne oil spill.

- Should an extreme pollution incident occur, work with the Department of Infrastructure and the Government to consider a temporary increase in levy rates to fund any shortfall.

- Seek a drawdown for a special appropriation should an extreme pollution incident occur.

Low Inflated or escalating costs

Escalating costs to provide regulatory activities to principle stakeholders and costs that may be beyond that deemed efficient.

Business processes may not be efficient or effective in the delivery of regulatory charging activities, with corporate overheads unnecessarily large. This may have negative long-term impacts on AMSA’s budget, or result in industry paying more in the recovery of costs than required – cost efficiency is an Australian Government cost recovery obligation.

High - Analyse direct costs, including staffing levels and classifications, average time in service delivery, ICT infrastructure (software) support, managerial engagement, and supplier (contractual) costs.

- Business process map tasks in the delivery of regulatory services and compare (benchmark) to other agencies providing similar services.

- Review and analyse all corporate related costs (property, networking, ICT, and corporate support), benchmarking to similar agencies – incorporate some measurement into key performance indicator reporting.

Low Key performance indicators

Not effective in measuring progress of specific activities, and not maintained as an ongoing and reportable measurement. Difficult to assess AMSA’s effectiveness in the delivery of services and progress in achieving policy outcomes to acceptable industry.

Medium - Engage and agree KPIs with external stakeholders.

- Report on KPIs in external published documents (e.g. annual report, PBS, and CRIS).

- Use KPIs and costing model outputs to support strategic decisions.

Low

- 5. Stakeholder engagement

Communication with stakeholders is an essential part of developing the CRIS, with adherence to AMSA’s Statement of Regulatory Approach.

AMSA published a consultative CRIS on its website and invited specific industry groups and participants to comment on its cost recovery arrangements; other groups, owners and operators, and the public were able to respond as well. The consultation was over a two-week period, commencing on 15 June 2020 and closing on 28 June 2020.

Industry groups invited to provide feedback included:

- Domestic Commercial Vessel Industry Advisory Committee

- Fishing Industry Advisory Committee

- Regional Safety Committees

- Ports Australia

- Marine Industry Association

- Ship Australia Limited

Key items raised by stakeholders during this consultation period were:

- Due consideration be given to general exemptions to volunteer (non-for-profit) marine rescue and service organisations and volunteers from National System fees and future levy.

- As part of the government review, ensure adherence to the key objectives for establishing a harmonised regulatory system – to operate in a more effective and efficient manner, reduce administrative burden (and costs to industry), and improve marine safety.

- Identify whether a material ‘public good’ component exists for the delivery of domestic marine services, and if appropriate, work with the Department of Infrastructure, Transport, Regional Development and Communications to develop options for government to consider for partial cost recovery.

Following consultation, AMSA responded appropriately to each response received.

A report detailing all feedback received from stakeholders on CRIS consultations over the previous year, with a summary of AMSA’s responses, will be prepared and published on the website in early 2020-21.

AMSA is still exploring options to implement a specific ongoing cost-recovery external stakeholder engagement strategy that will include performance measures and will involve consultation as part of the upcoming government review. Feedback from this process, as well as previous consultations, will inform AMSA of potential funding options that may be eventually considered by Government.

- 6. Financial estimates

Financial estimates for AMSA’s regulatory charging activity outputs for current (2019-20), budget (2020-21), and three forward year estimates, including explanations to material variances, is summarised in Table 8, with cumulative results in Table 9.

Table 8: Financial estimates for regulatory charging activities

Estimate

Budget

Forward Year Estimates

2019-20 ($’000) 2020-21 ($’000) 2021-22 ($’000) 2022-23 ($’000) 2023-24 ($’000) Navigational infrastructure (Marine Navigation Levy) Expenses (X) 36,762 33,976 34,460 34,958 35,468 Revenue (Y)* 36,189 36,300 36,800 37,400 38,000 Balance (Y - X) (573) 2,324 2,340 2,442 2,532 Explain material variances: In 2019-20, estimated accelerated depreciation of $2.6 million from switching off differential global position systems in June 2020. This will transfer to depreciation savings in budget and forward estimates. Environmental marine protection (Protection of the Sea Levy) Expenses (X) 16,161 27,821 28,218 28,625 29,043 Revenue (Y)* 36,335 36,500 37,000 37,600 38,200 Balance (Y - X) 20,174 8,679 8,782 8,975 9,157 Explain material variances: Clean-up operations for the MV Efficiency incident, which were completed in June 2020, are likely to end up $12 million less than the $27.1 million provision booked in 2018-19, resulting in a write-back of a proportion of this provision in 2019-20 – this surplus should be read in conjunction with the $23.5 deficit in 2018-19. Seafarer ship safety under Navigation Act 2012 and other Acts (Regulatory Functions Levy) Expenses (X) 43,501 49,423 50,129 50,852 51,595 Revenue (Y) 54,274 54,800 55,600 56,400 57,200 Balance (Y - X) 10,773 5,377 5,471 5,548 5,605 Explain material variances: From 2019-20 to 2020-21, redirection of cross-functional resources from domestic sector as National System transitional workloads decrease and service delivery defined. Marine services under Navigation Act 2012 and ship registration Expenses (X) 10,078 11,054 11,213 11,375 11,541 Revenue (Y) 3,343 3,400 3,400 3,400 3,400 Balance (Y - X) (6,735) (7,654) (7,813) (7,975) (8,141) Explain material variances: Continued under-recovery in fee-based activities, largely from qualifications and vessel inspections. Marine services for National System Expenses (X) 8,039 7,790 7,902 8,016 8,133 Revenue (Y) 2,731 3,300 3,300 3,300 3,300 Balance (Y - X) (5,308) (4,490) (4,602) (4,716) (4,833) Explain material variances: Continued under-recovery in domestic commercial vessel fee-based activities. Revenue in 2019-20 expected to decrease with lower volumes and COVID-19 relief provided to industry. * Revenue includes insurance recoveries for aids to navigation assets and insurance and legal settlements for environmental emergency pollution response.

Table 9: Financial estimates for regulatory charging activities

Estimate Budget Forward Year Estimates 2019-20 ($’000) 2020-21 ($’000) 2021-22 ($’000) 2022-23 ($’000) 2023-24 ($’000) Expenses (X) 114,541 130,064 131,922 133,826 135,780 Revenue (Y) 132,872 134,300 136,100 138,100 140,100 Balance (Y - X) 18,331 4,236 4,178 4,274 4,320 Cumulative balance 18,331 22,567 26,745 31,019 35,339 As noted, AMSA’s financial estimates provided here do not include the activity output for the National System regulatory-based seafarer and ship safety. Given the upcoming government review of this function, it is not possible to comment on forward years with any degree or level of accuracy, or without legislative funding provisions. To do otherwise would be confusing and counterproductive to users of this CRIS.

- 7. Financial performance

Historical financial performance of AMSA’s regulatory charging activity outputs, from 2013-14 to 2018-19, are shown in Table 10, including explanations of material variances. The cumulative results for regulatory charging activity outputs are included in Table 11.

Table 10: Historical performance of AMSA’s regulatory charging activities by output

2013–14 ($’000)

2014–15 ($’000)

2015–16 ($’000)

2016–17 ($’000)

2017–18 ($’000)

2018-19 ($’000)

Navigational infrastructure (Marine Navigation Levy) Expenses (X) 36,244 35,264 34,580 41,134 31,874 35,567 Revenue (Y)* 31,354 32,314 32,993 34,091 34,651 36,539 Balance (Y - X) (4,890) (2,950) (1,587) (7,043) 2,777 972 Explain material variances: In 2016-17, provision for removal of lead and asbestos content in AMSA’s aids to navigation sites (predominately lighthouses) was increased. The approximate movement in the provision during this year was $7.1 million. We are currently working through each of the identified sites through a program of scheduled works, to reduce this provision each year, with the aim to complete removal within the next few years. Environmental marine protection (Protection of the Sea Levy) Expenses (X) 34,871 32,795 34,654 29,128 30,219 62,707 Revenue (Y)* 39,253 31,268 37,259 34,068 36,494 39,234 Balance (Y - X) 4,382 (1,527) 2,605 4,940 6,275 (23,473) Explain material variances: There are natural timing variances associated with environmental emergencies, as clean-up operation costs incurred immediately from the date of an incident, whereas insurance recoveries typically received four to six years afterwards. For example, in 2015-16 AMSA received $4.3 million in recoveries from an incident that occurred in 2009-10. As AMSA has a constructive obligation to meet clean-up costs from ship-sourced marine pollution, in 2018-19 we booked a $27.1 million provision associated with containers that fell overboard from the MV Efficiency in June 2018. This operation finished in June 2020, with a proportion of this provision written-back in 2019-20. Seafarer ship safety under Navigation Act 2012 and other Acts (Regulatory Functions Levy) Expenses (X) 35,199 46,501 44,781 38,218 43,142 35,507 Revenue (Y) 46,315 48,349 49,266 51,211 52,488 53,470 Balance (Y - X) 11,116 1,848 4,485 12,993 9,346 17,963 Explain material variances: In 2016-17, AMSA undertook a workforce planning exercise, building capability to minimise duplication and increase collaboration across domestic and international areas of responsibility. An internal restructure carried out to support a more flexible and responsive organisation, resulting in a notable reduction in staff costs. For 2017-18 and 2018-19, there is a redirection of resources towards domestic sector due to unexpected level of transitional workloads associated with full service delivery of the National System. Marine services under Navigation Act 2012 and ship registration Expenses (X) 7,136 5,823 5,632 10,891 5,560 5,995 Revenue (Y) 4,111 3,658 4,631 4,849 3,959 3,813 Balance (Y - X) (3,025) (2,165) (1,001) (6,042) (1,601) (2,182) Explain material variances: Initial analysis indicates that the under recovery is largely within qualifications for seafarers and pilots. We are currently seeking to understand processes to determine whether costs are efficient or not. Depending on results of this analysis, AMSA will work with stakeholders and government to consider appropriate future arrangements. Marine services for National System Expenses (X) - - - 625 867 6,359 Revenue (Y) - - - 73 119 3,360 Balance (Y - X) - - - (552) (748) (2,999) Explain material variances: Three components appear to be driving the under-recovery, lower volumes (and revenue) than was originally anticipated, an increase in expected level of service delivery, and temporary inefficiencies as business processes are developed and refined subsequent to full service delivery on 1 July 2018. * Revenue includes insurance recoveries for aids to navigation assets and environmental emergency pollution responses. In relation to environmental emergencies, there is typically a four to six year delay in incurring expenditure associated with operational costs, which occurs immediately after an incident, and any eventually insurance recovery or legal settlement.

Table 11: Cumulative performance of AMSA’s regulatory charging activity outputs

2013–14 ($’000) 2014–15 ($’000) 2015–16 ($’000) 2016–17 ($’000) 2017–18 ($’000) 2018-19 ($’000) Expenses (X) 113,450 120,383 119,647 119,996 111,662 146,135 Revenue (Y) 121,033 115,589 124,149 124,292 127,711 136,416 Balance (Y - X) 7,583 (4,794) 4,502 4,296 16,049 (9,719) Cumulative 7,583 2,789 7,291 11,587 27,636 17,917 The cumulative balance for regulatory charging activity outputs from 2013-14 to 2018-19 is a $17.9 million surplus. This balance has been used in part to fund the development and implementation of a modern regulatory infrastructure framework applicable for both international and domestic commercial vessels.

Following the activity-based costing and zero-based budget exercise, we are now in a position to analyse business processes and corporate overheads to understand reasons for the imbalances (under and over recovery) of regulatory charging. As part of the government review, AMSA will develop strategies to address these imbalances, with extensive stakeholder consultation on any proposed changes.

- 8. Non-financial performance

Costing outputs through activity-based costing techniques is a powerful tool in management, providing accurate information on the costs of activities and processes in which to make informed decisions. However, it does not provide any in-depth analysis that may be symmetrically tracked (or measured) to assess achievement of predetermined objectives in support of AMSA’s policy outcomes. To achieve a more comprehensive analysis alignment of costing to performance indicators (or targets) is essential.

Effective performance measurement is key to ensure objectives are met in keeping with stakeholder expectations. Reporting on key performance indicators provides a consistent and repeatable framework to communicate goals, create measurable objectives, and it allows for benchmarking.

Performance indicators and measurements are based on non-financial, as well as financial information. These can be tricky to develop as indicators are usually confused with business metrics. A relevant performance indicator provides information that is significant and useful to AMSA and its stakeholders, and is attributable to activities.

In establishing key performance indicators, the SMART criteria is used:

S Is the goal of the activity specific?

M Can you measure progress towards that goal?

A Is the goal realistically attainable?

R How relevant is the goal to AMSA?

T What is the time-frame for achieving the goal?Overtime, the SMART criteria will be expanded to SMARTER with the additional of Evaluation and Revaluation. These last two steps are important to ensure the ongoing relevance of each measure.

KPIs for non-National System regulatory charging activities are summarised in Table 12, broken down by output, activity group, whether it is measuring efficiency or effectiveness, and rational and success factors – sourced from our Corporate Plan. AMSA has consistently achieved its targets.

Table 12: Performance targets for 2020-21

Navigational infrastructure (Marine Navigation Levy) Activity group

Effective or efficient

Details of key performance measure

Rationale and success factors

Provision and maintenance of aids to navigation

Effective Marine aids to navigation network’s availability complies with the targets set out in the International Association of Marine Aids to Navigation and Lighthouse Authorities (IALA) guidelines – as contained in O130 Categorisation and Availability Objective for Short Range Aids to Navigation: 99.8% Category 1 99.0% Category 2 97.0% Category 3 A high rate of reliability and availability across our aids to navigation network has a direct, positive relationship with vessels operating safely. Also measures the extent to which our aids to navigation contractor is meeting KPIs. Standards development Efficient 100% of regulatory measures are introduced consistent with international effect dates. A current, up-to-date regulatory framework influences the way ships operate and promotes safe shipping. Environmental marine protection (Protection of the Sea Levy) Activity group Effective or efficient Details of key performance measure Rationale and success factors National Plan pollution response Effective Zero number of significant pollution incidents caused by shipping in Australian waters – defined as a discharge of more than 50,000 litres or 50 tonnes of oil or hazardous waste. A low number of significant pollution incidents is a measure of AMSA’s success in preventing marine pollution. Effective 100% of maritime environmental emergency response assets are available for immediate deployment to a significant pollution incident – includes equipment, dispersants, fixed wing aerial dispersant capability, and emergency towage capability. Demonstrates that maritime environmental emergency response assets are available to be tasked and deployed in a timely, effective, and appropriate manner to combat marine pollution. Effective 100% sufficient numbers of trained maritime environmental emergency response personnel are available nationally to deploy and support incident management and response operations. Measures ability to provide appropriately trained State and Territory personnel to respond. Seafarer and ship safety under Navigation Act 2012 and other Acts (Regulatory Functions Levy) Activity group Effective or efficient Details of key performance measure Rationale and success factors Compliance Effective The inspection rate of risk assessed eligible foreign-flagged ships under the port State Control (PSC) program meets the following targets: 80% priority one ships 60% priority two ships 40% priority three ships 20% priority four ships Using the risk profile (P1=high, P4=low) of individual ships as a basis, our inspection regime – as a preventative measure – ensures we concentrate our resources on those ships that pose the greatest threat to safety and the environment. Effective 100% of inspections of high risk ships are conducted within targeted timeframes (every six months). Timely inspections of high-risk ships in particular, including passenger vessels, improves safety by identifying and rectifying faults (operator responsibility), and encouraging owners to operate vessels safely. Effective Annual number of port State control (PSC), flag State control (FSC) and domestic commercial vessel (DCV) inspections >7,460. By establishing representative samples by ship inspection type, we can monitor the quality of ships in Australian waters with some certainty, and determine whether trends are emerging that may pose a risk to safety and the environment. Effective Improvement in the standard of foreign flagged ships and Australian-flagged ships (under the Navigation Act 2012) operating in Australian waters is demonstrated through the: Average number of deficiencies per inspection compared to rolling ten-year average < 3.25 Percentage of ships detained as a proportion of all PSC inspections < 7.5% Proportion of serious incidents to total port arrivals < 0.5% Age of ships coming to Australia relative to age of worldwide fleet – at least 50% below worldwide average Monitoring trends on vessel standards allows us to gauge the effectiveness of our inspection and regulatory regime, identify emerging trends, and determine whether action is required. Effective Improvement in the standard of foreign flagged ships and Australian-flagged ships (under the Navigation Act 2012) operating in Australian waters is demonstrated through the: Average number of Maritime Labour Convention (MLC) deficiencies per inspection < 0.5% 100% of inshore complaints made under MLC investigated with specified timeframes Monitoring trends on vessel standards allows us to gauge the effectiveness of our inspection and regulatory regime, identify emerging trends, and determine whether action is required. The reporting against these targets will be contained in our 2020-21 Portfolio Budget Statements, Annual Report, and updated 2020-21 CRIS, all expected to be published in October 2020.

The development of key performance indicators for the National System has commenced through an internal consultative process undertaken with business-line managers. The Executive and accountable authority will review and approve these prior to holding an extensive consultative process with external stakeholders. Further, as part of the upcoming government review, AMSA will assess and redefine all performance indicators.

- 9. Key forward dates and events

Indicative dates for updating tasks throughout the 2020-21 budget year and beyond are listed in Table 13 – this does not incorporate the upcoming government review of AMSA’s operations scheduled in 2020-21 that will involve extensive and comprehensive stakeholder engagement.

Table 13: Indicative events and forward dates

Event Description Indicative date 2020-21 CRIS (updated for 2019-20 actual audited results) Update costing model and CRIS for consultative engagement following audited 2019-20 financial results, including engagement with external stakeholders and an update on the upcoming government review September 2020 Publish ministerial approved updated 2020-21 CRIS, incorporating any external stakeholder feedback October 2020 2020-21 CRIS (updated for MYEFO and/or additional estimates) Update costing model and CRIS for 2020-21 Mid-Year Economic and Fiscal Outlook (MYEFO) and/or additional estimates, including engage actively with external stakeholders February 2021 2021-22 CRIS (budget update) Update costing model and CRIS for consultative engagement for 2021-22 budget and update 2020-21 estimates, including stakeholder engagement April 2020 Publish ministerial approved 2021-22 CRIS, incorporating any external stakeholder feedback May 2021

- 10. CRIS approval and change register

CRIS approval and change registers from 2016-17 to 2019-20 are provided in Tables 14 (to be updated after the 2020-21 CRIS is approved).

Table 14: CRIS approval and change register

Date of change CRIS CRIS change Approval Basis for change 15 Sep 2016 2016-17 National System introductory fees Publication of 2016-17 CRIS for National System service delivery of introductory fees prior to charging non-government sector Approved by Minister for Infrastructure, Transport and Regional Development Initial release 29 Jun 2017 2016-17 Publication of 2016-17 CRIS, updated with 2015-16 audited actual results Certified by Chief Executive Officer Updated budget and current year estimates 27 Jun 2018 2018-19 National System full-service delivery for fees Publication of 2018-19 CRIS for National System full-service delivery for fee-based activities prior to charging the non-government sector Approved by Minister for Infrastructure, Transport and Regional Development Initial release 21 Dec 2018 2018-19 Publication of 2018-19 CRIS updated with 2017-18 audited actual results, incorporating National System introductory fees Certified by Chief Executive Officer Updated budget and financial results, incorporating National System introductory fee-based activities 20 Dec 2019 2019-20 Consolidated Publication of 2019-20 CRIS update with 2017-18 audited actual results, incorporating National System full-service delivery fee-based activities. Certified by Chief Executive Officer Updated with financial results and incorporating National System full-service delivery fee-based activities 23 Jul 2020 2020-21 Publication of 2020-21 CRIS updated with estimates for 2019-20 Certified by Chief Executive Officer Updated budget and current year estimates

- Appendix 1: Government policy approval and statutory authority

Summary of government policy approval to cost recover, including date of decision, and statutory authority to charge by activity output, with references, is provided below.

- Appendix 2: Methodology of costing

Principles applied

There are five principles that support the development of our costing model:

(1) Linked to strategic business planning: costing is not just a ‘bean counting’ exercise. It should be linked to the strategic direction and planning of AMSA, and inform executive at a strategic and tactical level.

(2) Holistic approach: a modelling exercise should include all revenue and operating expenditure, including overheads, other indirect costs, and capital expenditure (capital allowances and/or depreciation). Further, it should focus not just on cost recovery activities, but all activities of AMSA. This will result in a model that can fulfil multiple demands for costing information.

(3) Comprehensive and consistent: a simple approach that applies consistency in the application of modelling rules across all business areas and activities, creating a robust model understood by stakeholders. It should be developed over short timeframes, with a relatively small input of resources.

(4) Flexibility: it is important to recognise that demands for service delivery change over time, driven by various internal and external circumstances. A costing exercise must be dynamic in nature to evolve with changes to AMSA’s business requirements and circumstances.

(5) Institutionalised as a ‘normal’ function: modelling should be a living database that requires regular updating on a periodic basis. This is successful when the model receives official endorsement with AMSA wide involvement (operational area’s ‘buy-in’). Costing will then become a routine task and a ‘foundation stone’ for improving and reporting on financial performance.Methodology

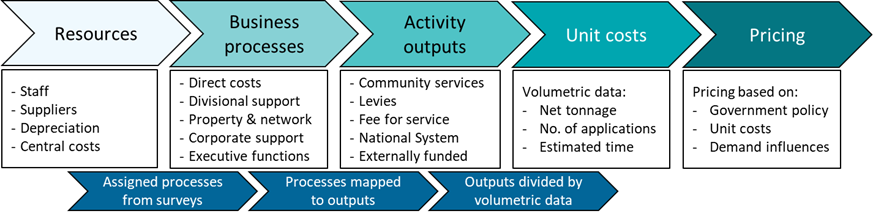

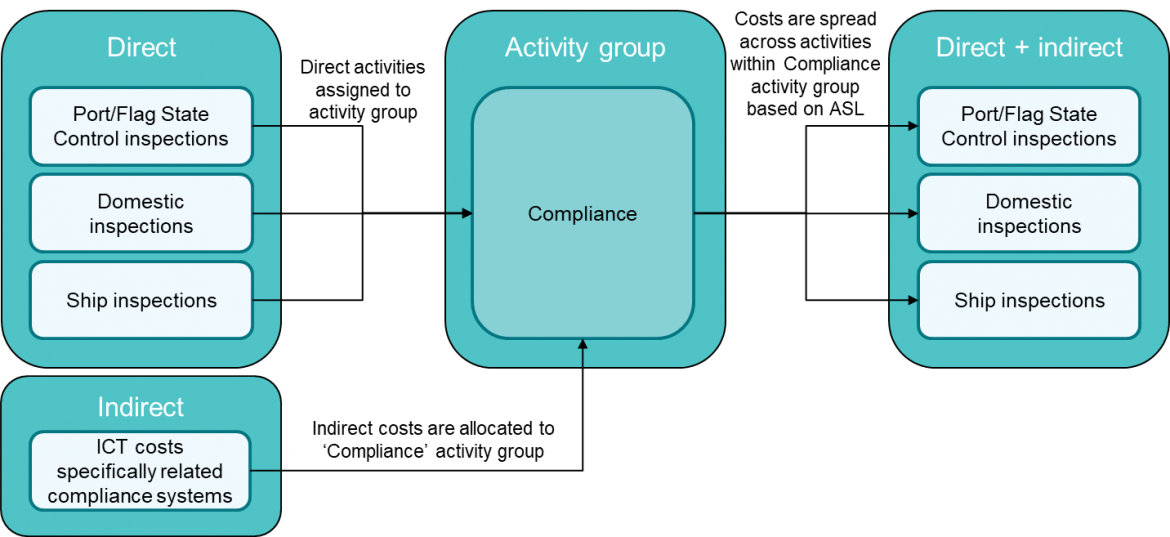

The methodology for modelling AMSA’s costs is summarised in the illustration below. It adheres to activity-based costing principles, which enables more analysis on the efficiency of activity outputs and/or business processes for cost recovery and other activities. It focuses on cost drivers, which allocates indirect costs to direct costs and then to an output.

Not all business processes are specific or direct in the provision of activity outputs. Several tasks are support related activities that simply enable the delivery of AMSA’s core outputs to stakeholders. Nevertheless, these should form part of the activity cost.

Cost categories

As part the costing methodology, we assign each activity to one of the following four cost categories to ensure appropriate identification of overheads for allocation to an activity.

- Direct: representing direct business processes (or tasks) relevant in service delivery of activity outputs.

- Indirect: exists to support the delivery of a direct activity. Examples include divisional support activities such as general management, specific ICT costs relating to systems to enable service delivery, and supporting property operating expenditure, ICT networking, and communication. Indirect processes are allocated to direct activities based on a cost object using an appropriate driver.

- Corporate overheads: enabling tasks and activities to support service delivery of AMSA’s activity outputs through provision of standard corporate and executive functions. Corporate overheads include executive, human resources, finance, governance, and general ICT support, accompanying their respective share of property operating expenditure, ICT networking, and communication. Similar to indirect, corporate overheads allocated to direct activities based on cost drivers.

- Depreciation: representing capital costs, asset register assessed on an asset-by-asset basis. Where there is a specific direct link to an activity, depreciation is assigned to an activity group, where corporate support related, depreciation is assigned to the appropriate overhead classification.

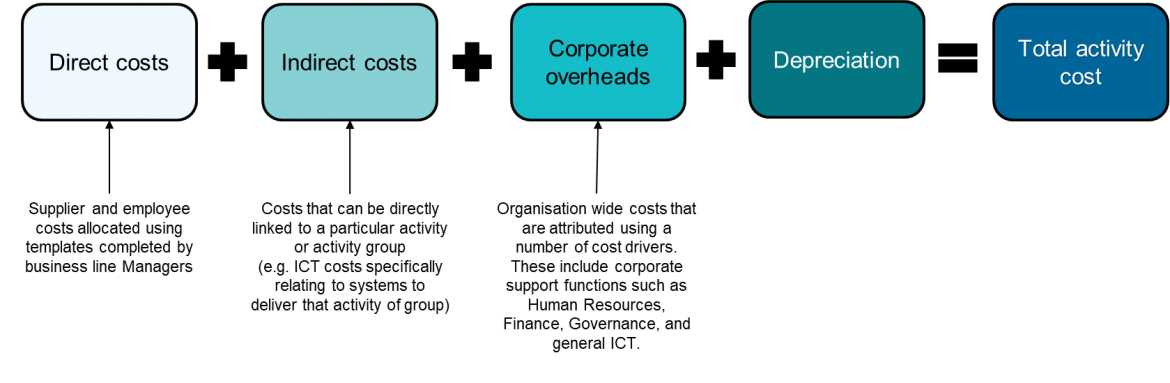

Below is an outline of the composition of an activity cost.

- Appendix 3: Approach in costing and developing model

Approach

As well as the principles in methodology detailed in Appendix 2, an effective model must be:

- Robust – in addition to the allocation of direct costs, a model must be capable of reliably allocating indirect and corporate overheads to direct activities.

- Defensible – assumptions and approach applied in determining cost allocations must be clearly documented and capable of withstanding external scrutiny, and

- Repeatable – model must be capable of supporting a repeatable process in future periods.

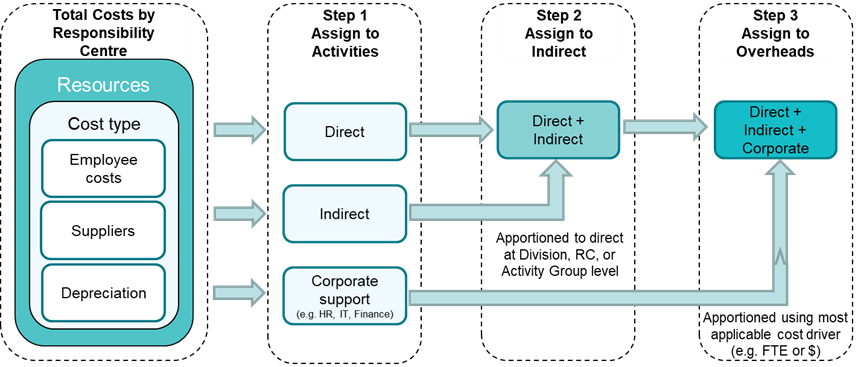

An illustration of the model approach applied in 2020-21 is detailed below.

Data collection and collation

The typical approach is to use data collection systems, such as timesheets, to gather information about drivers and use this for the allocation of costs to activities. AMSA does not currently collect timesheet data. Instead, the approach applied in 2020-21 is to use a data collection template with direct input from each business line area manager.

Managers assigned staff and employee costs (based on ASL equivalent grades), and supplier costs to activities and activity groups. During this data collection phase, managers provided:

- reasons why AMSA performs the activity, including how it is funded,

- whether the activity is ongoing, commencing, or terminating,

- description of activity drivers, including expected volumetric data per annum, expected impacts (risks, quality, benefits, service levels…etc.) for scenario levels, and justification for using the driver,

- risk assessment, identifying risk of not performing the activity, and

- corporate focus area aligning with Corporate Plan.

Overhead model

The collation of data collection templates determined direct costs for each activity output. To calculate fully absorbed costs of an activity output, an attribution of indirect and corporate support costs to each direct activity based on drivers is required. The overhead model applies several cost drivers.

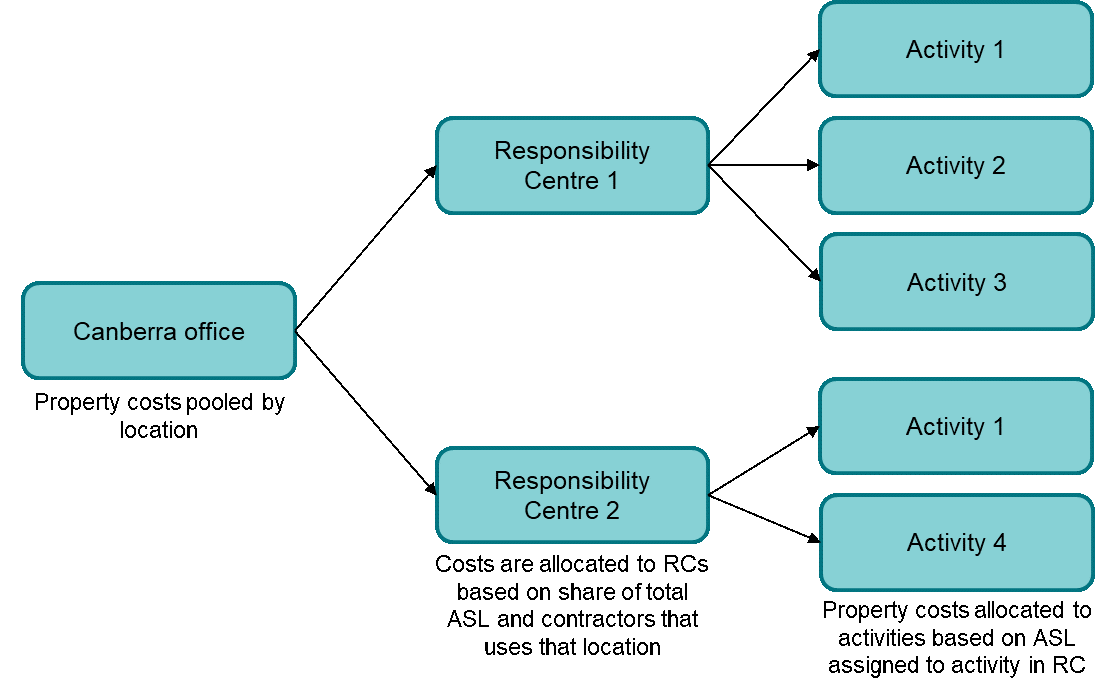

Allocation of indirect support costs

Activity groups are used to assembly similar activities for the purposes of allocating indirect support costs to direct activities. There are two levels of activity groups to provide options in accurately assigning costs:

- Activity group 1 – set at the highest level at which common activities can be identified.

- Activity group 2 – sets a lower level to allow for a more targeted approach to overhead allocation. It also allows for activities to be split between international and domestic industries.

Currently, indirect support costs are assigned to direct activities using direct ASL of that respective activity group as a cost-driver. The model has the flexibility to assign dollar values to specific individual activity groups. However, at this stage, ASL deemed the most appropriate as costs are influenced by the number of staff.

Where costs are incurred solely to support a specific group of activities, such as ICT hosting and support of software, the activity group is used to assign costs – as illustrated below.

The following indirect costs have been allocated in the model utilising activity groups:

- Support activities (excluding corporate overhead functions) required for the delivery of a group of activities, such as divisional management and administrative costs,

- Depreciation costs for assets that directly support a group of activities, and

- ICT operating expenditure on projects and systems that directly support a group of activities.

Property operating expenditure

Given its role, AMSA operates at numerous locations throughout Australia, leasing offices and storage facilities, as well as owning eight remote residential properties and one regional office. This corresponds to a sizeable property footprint and associated operational expenditure.

Property operating expenditure for office leases and residential properties are allocated by aggregating costs by location, and then directly allocated to each business line area in proportion of the respective number of staff and contractors utilisation that location – below is an illustration of this process.

Property operating expenditure for direct activities, such as aids to navigation sites or leasing space for National Plan stockpiles, are allocated directly to their respective activity outputs.

Corporate overheads

Corporate overheads allocated to direct activities using several cost drivers, depending on the nature of the expenditure, detailed below.

Overhead category Allocation method Rationale Executive functions Dollar cost (direct + indirect) Dollar costs appears the most reasonable given executive functions focus on strategic and risk, which is usually dictated by expenditure. Human Resources (HR) ASL Cost and resourcing of HR functions heavily influenced by volume of staff that are supported (e.g. payroll, recruitment, training, and performance management). Finance Dollar cost (direct + indirect) Primarily focused on areas of higher spend and risk. A higher cost requires ongoing financial management arrangements. While dollar cost for the allocation method is not a perfect cost driver, it provides a more accurate allocation than simply using ASL. Governance Dollar cost (direct + indirect) Focuses effort on organisational priorities and risk, with corporate planning the output. Strategically important activities receive additional management and analysis compared to lower risk (and generally lower cost) activities. ASL deemed unreasonable as governance function activities are not influenced by the number of staff. ICT general (excluding directly attributed activities) ASL Driven by the volume of staff and contractors supported (e.g. issuance of computers, help-desk requests, telephony and communications costs). Attribution of costs to non-regulatory charging activities

Staff providing regulatory charging activities may also undertake other activities funded by either government budget appropriations (search and rescue coordination services and regulatory function National System activities) or Australian Government agencies for targeted externally funded maritime related programs.

Costs for non-regulatory charging activities are identified during the collection and collation phase by direct input from business unit managers, with indirect and corporate overheads treated in the exact same manner as regulatory charging activities. This holistic approach (mentioned in Appendix 2) ensures a comprehensive model fulfilling multiple demands for costing, with no risk of omitting any costs from total activity outputs.

Sensitivities

Cost drivers and assumptions underlying the modelling are developed to limit and constrain any significant sensitivity from changes in demands of regulatory charging activities. Nevertheless, it is recognised that costs are sticky in the short-to-medium timeframe, predominately consisting of contracted suppliers and staff.

Supplier costs are largely longer-term contracts where expenditure relates to service requirements or deliverables. These are generally not dynamic or responsive to short-term changes in demand of regulatory charging activities. Staff costs have a similar constraint for short-term movements, and are based on long-term expected time and effort requirements to meet policy outcomes to an acceptable standard, as identified by business unit managers.

In determining the staff and supplier cost levels, AMSA forecasts the expected level of demand for regulatory charging activities as part of its annual budgeting processes. This process is based on historical data and trends, consultation advice, understanding known economic factors, and thorough communication with principle stakeholders. Although, externalities, such as COVID-19 disruptions, trade disputes, or austerity measures may impact resourcing and service delivery.

- Appendix 4: Schedule of fee-based charges

Fees under Navigation Act 2012 and other Acts

A schedule of the fee-based regulatory charging activities are listed below, with reference to Australian Maritime Safety Authority Fees Determination 2015.

Charge

Type

2019-20

2020-21