Please note this automated email inbox is unread and is for invoice submissions only.

How to format your invoice for AMSA?

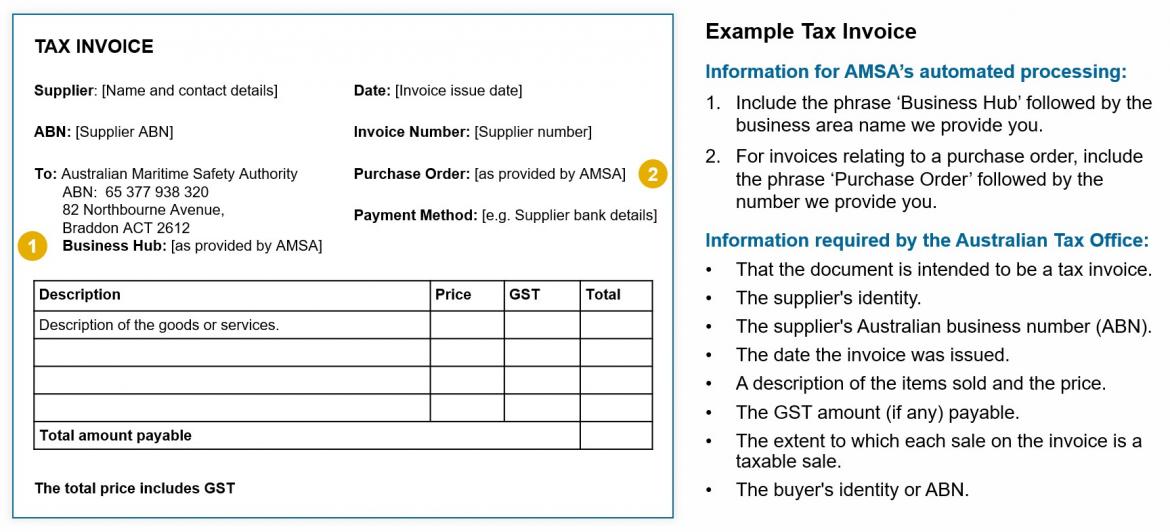

To benefit from our automated processing, you may need to update the format of your invoices:

- Business Hub name – Include the phrase ‘Business Hub’ followed by the relevant business area name we provide you. From 1 March 2022, the Business Hub name will be provided to suppliers by our purchasing officers whenever an order is placed, or a new purchase order is created.

- Purchase Order number – If your invoice relates to a purchase order, include the phrase ‘Purchase Order’ followed by the purchase order number we provide you.

Each invoice should only relate to a single purchase order. If there are additional items that are not related to the purchase order, these should be in a separate invoice.

- Correctly rendered Tax Invoice – Your invoice should include all the information required by the Australian Taxation Office under GST laws, as well as any other information stipulated in your contract with AMSA (if you have one).

- Save your invoice as a PDF – Your accounting software may automatically do this for you. The PDF must not be locked or password protected.

Example Tax invoice: Please note this is an example only and invoice layout may vary. Visit the Australian Tax Office website for more details on the requirements of tax invoices.

- How to submit your invoice to AMSA?

Email your invoice as a PDF attachment to invoices@amsa.gov.au. The email and all attachments should not exceed 20Mb.

- Attach one invoice per email – Each email should only relate to a single invoice.

- Attach supporting documentation – Simple supporting documentation can be included together in the same PDF document as the relevant invoice, or as an additional attachment in the same email that contains the invoice. Acceptable formats for supporting documentation include PDF, PNG, JPG, JPEG, TIF, TIFF, XLS, and XLSX.

If you are required to provide complex supporting documentation (e.g. detailed spreadsheets, video files or reports), please provide these directly to the appropriate AMSA project officer or contract manager.

- All information is in the attachments – The automated processing will not read the body of the email.

You will receive an automated reply to confirm your email has been received. The automated reply will come from AMSA_InvoiceCapture@concursolutions.com.

- What is my Business Hub name?

Our automated processing uses the ‘Business Hub’ details in the invoice to direct it to the right AMSA business area to be actioned by the right people as quickly as possible.

From 1 March 2022, a Business Hub name will be provided to suppliers by our purchasing officers whenever an order is placed, or a new purchase order is created. The business Hub name will be from the following list:

[Ops Central]

[Ops North]

[Ops East]

[Ops South]

[Ops West]

[Response]

[CEO/Board/Legal]

[Finance]

[HR]

[Property]

[IT Purchasing]

[Governance]

[CS Business Support]

[Policy and Regulation]

[Future Operations Taskforce]

- What is my Purchase Order number?

AMSA Purchase Order numbers are changing with the introduction of automated processing. For suppliers with new contracts or purchase orders generated from 1 March 2022, the purchase order number will be in the format:

- AMSAINT#####–1

- 22AMSA###–1

For suppliers with active contracts or purchase orders that were generated before 1 March 2022, you will be notified of your updated purchase order number by email in the last week of February 2022.

- Can AMSA receive e-invoices directly from my accounting software?

Not yet, but we are working towards it. AMSA’s automated processing is a precursor to being able to receive e-invoices directly from suppliers who are Pan European Public Procurement On-Line (PEPPOL) enabled.

PEPPOL is the international standard and network adopted by the Australian Government for electronic exchange of e-invoicing and other procurement documents.

More information on e-invoicing and PEPPOL is available from the Australian Taxation Office.

- Who do I contact if I have more questions about invoicing AMSA?

All inquiries about invoicing AMSA and any accounts related query can be sent to accountqueries@amsa.gov.au Bottom of Form