| PSC | FSC (RAV) | DCV | Total | |

|---|---|---|---|---|

| Total inspections | 2,405 | 95 | 2,671 | 5,171 |

| Total dertentions | 145 | 3 | 62 | 210 |

| Detention % | 6.0% | 3.16% | 2.32% | 4.1% |

| Total deficiencies | 6216 | 264 | 8769 | 15,249 |

| Deficiencies per inspection | 2.58 | 2.78 | 3.28 | 2.95 |

*DCV detentions include prohibition or direction to not operate due to deficient condition

Priority Groups – How do we prioritise inspections?

AMSA applies a dynamic risk profiling system to assist in allocating PSC inspection resources in the most effective manner. The risk factor does not mean the ship is a high risk as such, it is simply a statistical tool to prioritise inspections. AMSA’s risk calculation uses multiple criteria to categorise ships into four priority groups, to calculate a risk factor for the ‘probability of detention’. Each group has a specific target inspection rate as shown below.

Table 3 & 4 show the prioritization of inspection for PSC & DCVs.

FSC (RAV) Target inspection rate

Regulated Australian Vessels (RAVs) are eligible for inspection every six (6) months, similar to the eligibility of foreign ships for PSC inspections. AMSA applies the same algorithm to RAVs as to PSC inspections. AMSA’s National Compliance Plan (NCP) identified that we would focus on inspecting Australian ships that have not visited an Australian port within eight (8) months previously, based on their risk profile. As COVID-19 restrictions ease globally, AMSA will prioritise the inspection of Australian ships that operate overseas, in accordance with their risk profile.

| Priority group | Risk factor (probability of detention) | Target inspection rate | Actual inspection rate | Inspection rate with no deficiency |

|---|---|---|---|---|

| Priority 1 | 6 or higher | 80% | 88.5% | 35.5% |

| Priority 2 | 4 or 5 | 60% | 68.9% | 41.2% |

| Priority 3 | 2 or 3 | 40% | 43.9% | 35.3% |

| Priority 4 | 0 or 1 | 20% | 24.5% | 46.4% |

| Priority group | Risk score | Target inspection rate | Min inspection frequency |

|---|---|---|---|

| Priority 1 | ≥19 | 80% | Eligible every 12 months |

| Priority 2 | 17-18 | 30% | Eligible every 24 months |

| Priority 3 | 15-16 | 10% | Eligible every 48 months |

| Priority 4 | 0-14 | 2% | Eligible every 60 months |

For DCVs, targeting is calculated for the Australian financial year (1 July to June 30). AMSA employs a targeting prioritisation model for DCVs that is risk-based. Several factors are used to calculate a risk score for DCVs including compliance history, age of a vessel, construction, operation, and certification status. The higher the risk score the more frequently a DCV is likely to be inspected.

AMSA continues to refine the DCV risk calculator based on evolving inspection data, allowing further refinement of risk scores and prioritisation.

For details of the DCV targeting models used during 2022 refer to the AMSA National Compliance plans for 2021-22 and 2022-23:

What is a deficiency?

PSC & FSC (RAV)

The IMO defines a deficiency as ‘a condition found not to be in compliance with the requirements of the relevant convention’. Serious deficiencies contribute to the ship being substandard or unseaworthy. AMSA will issue a ship with a deficiency if it is determined, or reasonably suspected, that the condition of a ship, its equipment, or performance of its crew does not comply with the requirements of relevant international conventions.

As shown in Appendix 1, Table 8, there was an increase in four out of five deficiency types in PSC. This is likely attributed to the continued effects of COVID-19 on the ability of ships to be effectively maintained.

Deficiencies by category and ship type - PSC

For reporting purposes, deficiencies have been categorised into groups that identify key areas of non-compliance, being structural/equipment, operational, human factors, ISM (safety management) and MLC (living and working conditions). Appendix 1, Table 6 identifies the number of deficiencies by category along with a comparison of the deficiency rates to those in 2021.

If the number of deficiencies is considered in isolation, as depicted in Table 6, the majority of deficiencies were issued to bulk carriers. However, this is not surprising given bulk carriers accounted for 54 per cent of ship arrivals and 49 per cent of all inspections. To assess the performance of ship types, it is necessary to compare the deficiencies per inspection for each category as provided in Appendix 1 table 7. Ships with less 10 inspections have not been included in the below summation.

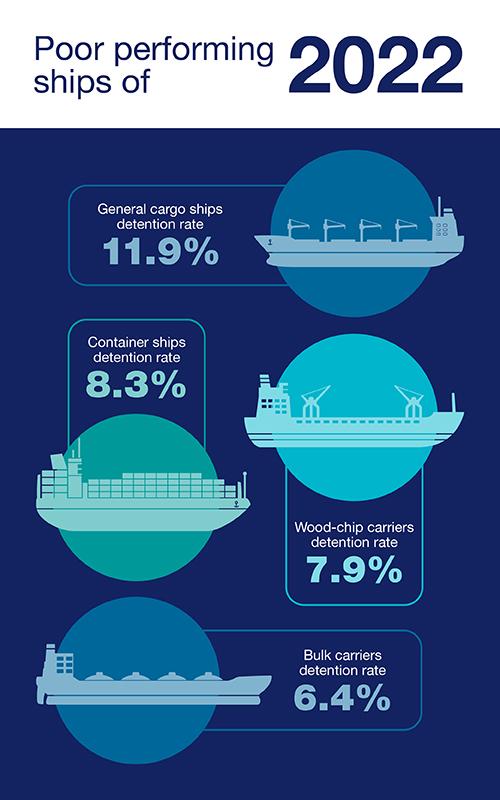

- General cargo ships are the poorest performing ships, with a detention rate of 11.9 per cent, and the rate of deficiencies per inspection by category are higher than average for all categories.

- Container ships were the next poorest performing ship type, with a detention rate of 8.3 percent and the rate of deficiencies per inspection by category are higher than average for all categories.

- The average age of container ships continues to increase to an average of 15 years old in 2022, from an average age of 10 years old in 2013. AMSA continues to have a strong focus on cargo securing and the safe carriage of cargoes, and this is reflected in the deficiencies issued to container ships.

Appendix 1, Table 6, 7 & 8 provide more granular information on deficiencies issued as part of a PSC.

DCV

Marine Safety Inspectors will issue a DCV with a deficiency if they reasonably believe that a condition on the DCV is in contravention of the National Law Act 2012, including associated regulations and standards. Deficiencies which are assessed as having a high risk to safety of persons or the environment will likely lead to further compliance action.

The most common deficiencies on DCVs were identified in life saving appliances (24 per cent of all deficiencies), followed by SMS (21 per cent of all deficiencies) and Fire Safety (16 per cent of all deficiencies). These three deficiency categories account for over 60 per cent of all deficiencies issued to DCVs. More detail is provided in Appendix 2, Table 3 and 5.

The highest deficiency rates (deficiencies per inspection) for DCVs were identified in passenger vessels (3.67) and fishing vessels (3.66) followed by Non-Passenger (2.93) and Hire and Drive (2.56). Additional focus was placed on passenger vessels during 2022 due to a focused inspection campaign on passenger safety procedures. Fishing vessels had the highest share of detainable deficiencies recorded (47.7%) followed by passenger vessels (32.9%), non-passenger (18.1%) and Hire and Drive (1.3%). Refer Appendix 2, Table 6 for more detail.

FSC

A comparison of the FSC to PSC data shows that Australian flagged RAVs have performed better than foreign flagged ships in all deficiency rates per category, except in operational deficiencies, where RAVs were more than twice that of foreign flagged ships (RAV deficiency rate is 0.9 and PSC is 0.4).

AMSA plans to provide greater focus on these operational deficiencies in the future, particularly on Australian flagged ships.

Appendix 3, Table 1 & 2 provide more granular information on deficiencies issued to RAVs.

| Structural/ equipment | Operational | Human factor | ISM/SMS | MLC | |

|---|---|---|---|---|---|

| PSC - Totals | 3068 | 1003 | 940 | 299 | 1006 |

| category deficiency rates | 1.2 | 0.4 | 0.4 | 0.1 | 0.4 |

| RAV - Totals | 106 | 86 | 35 | 8 | 29 |

| category deficiency rates | 1.12 | 0.9 | 0.36 | 0.08 | 0.31 |

| DCV - Totals | 4755 | 1418 | 174 | 1843 | 579 |

| category deficiency rates | 1.78 | 0.53 | 0.07 | 0.69 | 0.22 |

From this, the following can be inferred

- Structural/equipment deficiencies are the most common type of deficiency from any inspection.

- ISM/SMS deficiencies are more commonly found on DCVs

- Operational deficiencies are more commonly found on RAVs

Detention – PSC & FSC (RAV)

What is a detention?

The IMO Guidelines on PSC define a detention as: ‘intervention action taken by the port State when the condition of the ship or its crew does not correspond substantially with the applicable conventions to ensure that the ship will not sail until it can proceed to sea without presenting a danger to the ship or persons on board, or without presenting an unreasonable threat of harm to the marine environment, whether or not such action will affect the scheduled departure of the ship’.

Australia is aware that a ship detention is a serious decision, and only makes the decision where a ship cannot set sail without presenting a danger to the ship, persons onboard or a threat of harm to the marine environment.

In line with the IMO Guidelines, ships which are unsafe to proceed to sea will be detained upon the first inspection, irrespective of the time the ship will stay in port; and the ship will be detained if the deficiencies on a ship are sufficiently serious to merit a PSCO returning to the ship to be satisfied that they have been rectified before the ship sails.

Detainable deficiencies by category – PSC

General cargo and container ships continue to perform poorly

Table 11 shows the proportion of detainable deficiencies in different categories over a two-year period. As indicated in the table, the detainable deficiencies relating to the category of ISM remained the highest, though increasing in share in 2022 (29.1 per cent of detainable deficiencies) as compared to 2021 (24 per cent of detainable deficiencies). Along with ISM, the categories of fire safety, emergency systems, lifesaving appliances and Labour conditions were the top five categories of detainable deficiencies. AMSA’s firm stance on ensuring seafarer’s fundamental rights are upheld is shown in labour conditions being the 5th most detainable deficiency, increasing to 7.3 per cent of all detentions (from 5.4 per cent in 2021)

The high proportion of detainable deficiencies for ISM shows that safety management systems continue to be poorly implemented. In 2013, the number of ISM detainable deficiencies was 120 (31.2 per cent of all detainable deficiencies). AMSA’s shift in focus to planned maintenance, particularly in relation to main engines and power generation reliability is reflected in this increase of ISM detainable deficiencies.

Detentions (DCV)

For deficiencies that are a high risk to safety of persons or the environment AMSA may use a National Law notice to ensure that the DCV does not operate until the high-risk deficiency is rectified. This could be in the form of a prohibition notice, a direction notice or a detention notice.

The most common detainable deficiency for the DCV fleet was related to structural conditions, accounting for 24 per cent of all detentions (36 in total). SMS was the 2nd most commonly detainable item accounting for 23.5 per cent (35 in total) followed by lifesaving appliances at 18 per cent (27 in total). These three categories accounted for over 65 per cent of all detainable items found on DCVs.

Appendix 2, Table 7 provides more information regarding detainable deficiencies on DCVs.

Detentions (RAV)

Appendix 3, Table 3 shows the detainable deficiencies by category for RAVs. Due to the relatively low number of detentions against each type, there is limited statistical analyses that can be inferred.

High Performing Operators - PSC

When considering ship performance, AMSA also considers the performance of operators in respect of the detention and deficiency rates of the ships they operate. In this report AMSA has identified operators that are considered to be high performing. This is assessed on the following basis:

- At least 10 inspections during the year (less than 10 is not statistically significant)

- No detentions during the year

- A deficiency rate at no more than 70% of the average deficiency rate for the year.

Applying these criteria to data for 2022, AMSA identified 29 high performing operators as listed in Table 21 below. This is an increase of four operators compared to 2021.

| Company number | ISM company name | PSC inspections | Deficiency rate |

|---|---|---|---|

| 0255909 | Taiyo Nippon Kisen Co Ltd | 29 | 0.41 |

| 1578540 | CSC Nanjing Tanker Corp | 21 | 1.38 |

| 5463827 | CMA CGM International Shipping Co Pte Ltd | 20 | 1.80 |

| 5562457 | Scorpio Marine Management (India) Pvt Ltd | 20 | 1.50 |

| 5634079 | Dorval Ship Management Kk | 19 | 0.16 |

| 1249148 | Orient Overseas Container Line Ltd (OOCL) | 18 | 1.56 |

| 1968365 | NYK Shipmanagement Pte Ltd | 18 | 0.72 |

| 5527921 | The China Navigation Co Pte Ltd | 18 | 1.00 |

| 5567926 | Dockendale | 18 | 0.89 |

| 5261954 | MOL Shipmanagement [Singapore] Pte Ltd | 17 | 0.59 |

| 5362413 | Livestock Express BV, Netherlands | 17 | 1.24 |

| 5926452 | Cosco Bulk Carrier Co Ltd (Cosco Bulk) | 17 | 1.00 |

| 0034961 | Zodiac Maritime Agencies Ltd | 15 | 1.67 |

| 0979251 | Meikai Marine Services Co Ltd (MMS) | 14 | 0.93 |

| 5020687 | Wallenius Marine AB | 13 | 1.54 |

| 5912498 | Cosco Shipping Energy Transportation Co Ltd | 13 | 1.31 |

| 0022438 | Hyundai Merchant Marine Co Ltd (HMM) | 12 | 1.33 |

| 0522961 | Anglo-Eastern Ship Management Ltd | 12 | 1.00 |

| 1204098 | Wilhelmsen Ship Management (Norway) AS | 12 | 0.17 |

| 1540341 | Shenzhen Ocean Shipping Co Ltd (Cosco Shenzhen) | 12 | 0.67 |

| 1677771 | Anglo-Eastern Shipmanagement (S) Pte Ltd | 12 | 0.67 |

| 4115119 | Fleet Management Ltd | 12 | 1.08 |

| 0694657 | MOL Ship Management Co Ltd (Molship) | 11 | 0.09 |

| 1966806 | Anangel Maritime Services Inc | 11 | 0.55 |

| 5404929 | Yangtze Navigation (Hong Kong) Co Ltd | 11 | 1.36 |

| 6069701 | Stolt Tankers BV | 11 | 0.45 |

| 0020825 | Wilhelmsen Ship Management Sdn Bhd | 10 | 0.90 |

| 0605971 | Shunzan Kaiun Co Ltd | 10 | 1.30 |

| 1314173 | Zodiac Maritime Agencies Ltd | 10 | 0.80 |

Recognized Organizations & Accredited Marine Surveyors (AMS)

Recognized Organizations (ROs) are authorized to undertake survey and certification functions on behalf of flag States. There should be a careful distinction between a RO who issues or endorses Statutory Certificates on behalf of an Administration and a Classification Society who issues hull and machinery and other non-statutory or ship related certificates. ROs are required to comply with the IMO RO Code (MSC. 349(92).)

During a PSC or FSC inspection, where a ship is detained, and the attending PSCO or FSCO forms the view that the defect would likely have existed during the previous survey, they may assign the RO as responsible for the defect.

As part of ensuring that ROs are undertaking their statutory functions in accordance with the AMSA Instructions to Class AMSA periodically audits ROs against the RO Code.

During 2022, audits were undertaken for Lloyds Register (LR) and Det Norske Veritas (DNV) as part of AMSA ensuring that RAVs are surveyed appropriately.

A Table of RO performance during PSC inspections can be found in Appendix 1, Table 16

During 2022, 45 audits of AMSA were undertaken. Two of these audits resulted with AMS having their accreditation being varied.

| Total Audits | Audits with Corrective Action | Audits resulting in Counselling Letter | Audits resulting in Show Cause | Number of AMS with accreditation varied |

|---|---|---|---|---|

| 45 | 20 | 3 | 2 | 2 |

Refusal of Access Directions

Australia is a signatory to various International Maritime Organization (IMO) and International Labour Organization (ILO) conventions which aim to ensure ships are safe.

Ships that are not operated and managed to meet applicable minimum standards and relevant Australian laws pose an increased risk to seafarers, ships and the environment. The Navigation Act 2012 gives AMSA the power to direct that a ship be refused access to Australian ports. AMSA exercises that power on rare occasions where a ship is repeatedly detained, has a poor PSC record, or there are concerns about the performance of the ship operator. We promulgate our policy on refusing access on our website.

AMSA can issue a ship with a direction not to enter or use an Australian port (or ports) for a set period, as deemed necessary. When considering ship performance, AMSA also looks at the performance of the entire company responsible for the operations of the ship. Where the company’s performance is also deemed unacceptable, the periods for which the ship is not permitted to enter an Australian port may be extended. A direction resulting from a detention will generally take effect as soon as the ship leaves the Australian port or anchorage following rectification of the detainable deficiency.

AMSA publishes a list of ships that are refused access to Australian ports on our website.

AMSA also publishes a list of “poor performing operators”, these operators have been observed to have a detention rate 1.5 times the AMSA average over two years. These operators generally have at least 10 inspections, although discretion may be used by AMSA when an operator has been shown to have a particularly poor PSC performance.

AMSA analyses the overall performance of companies whose ships come to Australia. The analysis of the company’s performance is over 24 months, with a minimum of 10 inspections. Where the company’s detention rate is found to be 1.5 times the preceding 24-month average detention rate for all ships in Australia, the company is considered a poor performing company by AMSA.

Appendix 1, Table 14 lists the ships issued with directions not to enter or use an Australian port in 2022.

Appendix 1, Table 15 lists the Company’s issued with a poor performance letter during 2022.